After the demise of Silicon Valley Bank and Signature Bank in March, a study on the fragility of the U.S. banking system found that 186 more banks are at risk of failure even if only half of their uninsured depositors (uninsured depositors stand to lose a part of their deposits if the bank fails, potentially giving them incentives to run) decide to withdraw their funds. What does this study mean for real estate lending? How accurate are these predictions.

What was in the data on possible bank failures?

After the demise of Silicon Valley Bank and Signature Bank in March and First Republic Bank in April, a study on the fragility of the U.S. banking system found that 183 more banks are at risk of failure even if only half their uninsured depositors—those with deposits greater than $250,000—decide to withdraw their funds, USA Today reported.

“The recent declines in bank asset values very significantly increased the fragility of the U.S. banking system to uninsured depositor runs,” economists wrote in a recent paper published on the Social Science Research Network. “So, our calculations suggest these banks are certainly at a potential risk of a run, absent other government intervention or recapitalization.”

“Even if only half of uninsured depositors decide to withdraw, almost 190 banks with assets of $300 billion are at a potential risk of impairment, meaning that the mark-to-market value of their remaining assets after these withdrawals will be insufficient to repay all insured deposits. If uninsured deposit withdrawals cause even small fire sales, substantially more banks are at risk.”

What was the methodology used to predict future bank failures:

The methodology used by the study to predict possible bank failures seems logical. Essentially they are calculating which banks have the most uninsured deposits as a percentage of liabilities.

“We illustrate in a simple model that uninsured leverage (i.e., Uninsured Debt/Assets) is the key to understanding whether these losses would lead to some banks in the U.S. becoming insolvent– unlike insured depositors, uninsured depositors stand to lose a part of their deposits if the bank fails, potentially giving them incentives to run. We show that a bank’s survival depends on the market beliefs about the share of uninsured depositors who will withdraw money following a decline in the market value of bank assets. If interest rate increases are small such that the bank’s decline in asset values is relatively small, there is no risk of a run equilibrium. However, for sufficiently high increases in interest rates, we have multiple equilibria in which uninsured depositor run making banks insolvent (i.e., a “bad” run equilibrium) becomes a possibility. Banks with smaller initial capitalization and higher uninsured leverage have a smaller range of beliefs supporting a “good” no run equilibrium, increasing their fragility to uninsured depositor runs.”

How accurate is the prediction of more bank collapses?

I always take bold statements with a grain of salt. After reading the study, there are a number of more questions that could radically alter the predictions

- Study could miss other at risk institutions: For example, if a bank has a large exposure to commercial office properties in their portfolio, even with a sound deposit base, they still could fail as the assets on the books are marked down considerably.

- Not all deposits are equal: I’m not sure how you gauge the deposit flight risk, but some depostis are much more sticky than others. For example, is a small business who has a relationship with a bank more likely to keep their deposits there? Some banks also have deposit requirements for lending which will further contain withdrawals.

Bank run is dependent on an event/trigger

Just like stock market bull runs, they typically do not die of old age. There is a trigger that changes the paradigm. The same is true for any upcoming bank crisis. If rates decline later this year, we could totally avert a major crisis. On the other hand if rates rise more than forecast then we could be in for an even larger bank catastrophe.

My gut says the next crisis will not be fueled solely by a deposit run. The swift decline in commercial real estate prices will ultimately set off the next cycle.

What does a prospective banking crisis mean for real estate lending?

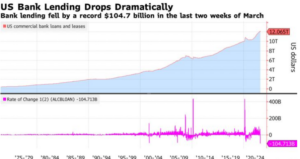

Regardless of if there is a bank crisis or when it occurs, the byproduct is tightening credit and reduced lending. Although, it didn’t highlight the actual banks in this study, they each know who they are and accordingly have reduced lending to preserve capital. With the threats of bank runs, no small bank wants to be caught in a liquidity crunch so they are lending less and holding more cash to hedge their bets.

Real estate prices will fall

With reduced lending and tighter credit conditions, commercial real estate will be hit hard. The majority of small/mid size commercial loans are done by smaller regional banks. Without access to credit and/or credit that is priced substantially higher prices of commercial real estate will fall. The million dollar question is how far will prices go before finding a bottom.

Summary

The recent study predicts another 190 banks are at risk of failure. Even if that number is half, that would still be a big shock to the economy. Although it is difficult to pinpoint an exact number of failures, the damage has already been done as hundreds of regional/mid size banks tighten credit conditions to prevent becoming a target for another bank failure.

As credit conditions tighten and lending becomes more difficult commercial real estate will feel the pain the hardest with declining prices. The million dollar questions are how far will prices fall before finding the bottom, will the bank tightening spread to the residential side, and ultimately what happens to the economy.

Additional Reading/Resources

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4387676

- https://www.usatoday.com/story/money/personalfinance/real-estate/2023/03/19/svb-collapse-new-banks-could-fail/11504269002/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender