Households added $148 billion in overall debt, bringing the total to $17.05 trillion, according to a report released by the Federal Reserve Bank of New York on Monday. Balances are now $2.9 trillion higher than just before the pandemic. What categories are consumers increasing their debt? What does this mean long term for the general economy and in turn real estate?

Where are consumers increasing their debt?

The total for borrowing across all categories hit $17.05 trillion, an increase of nearly $150 billion, or 0.9% during the January-to-March period, the New York Federal Reserve reported Monday. That took total indebtedness up about $2.9 trillion from the pre-Covid period ended in 2019.

That increase came even though new mortgage originations, including refinancings, totaled just $323.5 billion, the lowest level since the second quarter of 2014. The total was 35% lower than in the fourth quarter of 2022 and 62% below the same period a year ago.

In the chart, three numbers jumped off the page. The huge increases in Auto, credit card, and other debt are astounding.

What is the huge blind spot in the debt data?

The huge increases in consumer debt are startling, but there is one enormous blind spot in the data. Buy now pay later lenders are not fully accounted for in this data as they are not uniformly reported on credit reports.

As of 2021, 60% of consumers have reported using a BNPL service. Out of those consumers, 46% are still making payments. Industry estimates put personal loans like buy now pay later over 100 billion dollars. Although it is not a huge number compared to the 93 trillion in auto debt it is still a huge blind spot and show consumers are likely adding even more debt that the federal reserve is tracking.

More debt means considerably more risk

We have seen in every single economic cycle that the more debt the more volatile the market can be. This current cycle is no different and is likely even a bit more dangerous for debt laden consumers. The Federal reserve has drastically increased interest rates making variable debt like credit card drastically more expensive. Furthermore, new auto loas (although typically not variable) are starting with much higher interest rates. As rates continue to stay constant or possibly increase, the amount of money needed to service the debt will also need to increase. Interest rates are rising far faster than incomes so at some point consumers will reach a breaking point due to their debt load.

Signs of stress starting for consumers

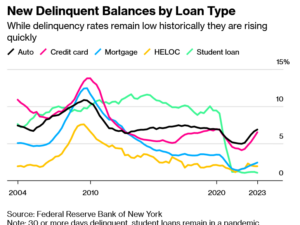

US households showed signs of increasing financial stress in the first quarter, with credit card balances not declining in the way they typically do at the start of the year and delinquencies rising for most types of consumer loans.

Consumers typically build up more credit-card debt at the end of the year, during the holiday season, and then reduce those balances at the start of the following year, sometimes with the help of tax refunds. But for the first time in 20 years, that wasn’t the case this year, suggesting some households are under strain from higher prices and may be relying on credit cards to maintain their spending.

Delinquency rates for all debt increased, up 0.6 percentage point for credit cards to 6.5% and 0.2 percentage point for auto loans to 6.9%. Total delinquency rates moved up 0.2 percentage point to 3%, the highest since the third quarter of 2020.

When will consumers “break”?

There seems to be a ton of optimism in the market that the higher interest rates will be a blip. This appears to be lulling consumers into not worrying too much about their variable debt as rates will quickly come down. Here is what the federal reserve bank of Atlanta president had to say: “My baseline case is we won’t really be thinking about cutting until well into 2024,” Bostic said Monday in an interview on CNBC. “If you look at most measures of inflation, they’re still two times where our target is. And so that’s a long distance still to go.”

The federal reserve has been clear that rates will likely stay higher for longer, but unfortunately the market is not buying this and factoring in a quick reduction in rates. I tend to believe the federal reserve as inflation continues to stay well above their targets which will lead to rates staying high or possibly edging even higher. As the cost of variable debt remains very expensive coupled with rising unemployment consumers will likely be pushed over the edge later this year or early next year.

Summary

Large increases in consumer debt are a warning sign for the economy. At some point the consumer debt must be repaid and as rates remain high the cost to service the debt will continue to increase. Consumers have been lulled into a false sense of security that this cycle will be like the last several cycles where interest rates rapidly decline.

Unfortunately with inflation well over double any of the federal reserve targets, it is going to be difficult for rates to fall quickly. As rates remain higher for longer, many consumers will ultimately “break” as they will not have the cash flow to continue servicing their debt. So far the consumer is holding up very well in light of higher interest rates, but the tides look to be starting to shift. Later this year will be the real test of how much consumers can bend before breaking. This will lead to defaults and ultimately a pull back in consumer spending. Eventually this will flow through to real estate with prices adjusting as the economy slows/falls.

Additional Reading/Resources:

- https://www.bloomberg.com/news/articles/2023-05-15/us-households-show-signs-of-stress-new-delinquencies-rise?srnd=premium

- https://www.cnbc.com/2023/05/15/consumer-debt-passes-17-trillion-for-the-first-time-despite-slide-in-mortgage-demand.html

- https://www.bankrate.com/loans/personal-loans/buy-now-pay-later-statistics/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, consumer debt