US commercial real estate prices have fallen this year for the first time in more than a decade, according to Moody’s Analytics, heightening the risk of more financial stress in the banking industry. What property types are declining? (hint not just office properties). What is the only property type that held in positive territory? Is the recent drop in prices just a blip or the start of a bigger trend? Why are prices falling now while the economy continues humming along?

What was in the most recent commercial data?

The recent CoStar report, the leading aggregator of commercial data, showed declines in Office, retail, and apartments. CoStar has some of the best insight into commercial property values as they also track heavily via Loopnet (largest commercial MLS)

- THE PRIME INDUSTRIAL INDEX LED GROWTH AMONG THE FOUR MAJOR PROPERTY TYPES. The Prime U.S. Industrial Index was up 2.5% in the first quarter of 2023 and 10.8% in the 12 months ending in March 2023. The equal-weighted U.S. Industrial Index, including a broader mix of asset qualities, underperformed the Prime Index with a modest decline of 0.1% in the quarter. The Prime Industrial Index was the only Prime property type index to hold in positive territory in the first quarter.

- MULTIFAMILY INDEX DECLINES. The equal-weighted U.S. Multifamily Index fell by 2.4% in the first quarter of 2023 and dropped 2.2% in the 12 months ending in March 2023. The U.S. Multifamily Index showed the sharpest annual decline in values since the interest rate hiking cycle began in the first quarter of 2022. Debt for multifamily transactions was plentiful and drove investor demand in the sector. The index appreciated by 2.8% in the 12 months ending in March 2023 in Prime Multifamily markets but fell 2.8% in the quarter.

- OFFICE PRICE DECLINES CONTINUED IN THE FIRST QUARTER. The U.S. Office Index sagged 2.4% in the first quarter of 2023, taking its cumulative decline to minus 5% during the previous three quarters. Office prices were down 1.4% in the 12 months ending in March 2023, marking the first annual decline since the second quarter of 2012. In addition, pricing growth in the Prime Office Index advanced at a negligible pace of 0.4% in the 12 months ending in March 2023 while slumping 2.8% in the quarter.

- RETAIL PRICING FOOTED SIDEWAYS IN THE FIRST QUARTER. The U.S. Retail Index rose just 0.2% in the first quarter of 2023 and 3.3% in the 12 months ending in March 2023. The tendency of high-profile pair trends to swing the data around at the top end of retail space can lead to strong quarterly fluctuations. The U.S. Prime Retail Index dipped 2.6% in the first quarter while appreciating 12.3% over the year prior. The three-quarter trend in the Prime Retail Index saw values surge 9.9% in the third quarter of 2022 before giving back 2.8% and 2.6% in the fourth quarter of 2022 and the first quarter of 2023, respectively.

Why is multifamily declining as rents are staying high?

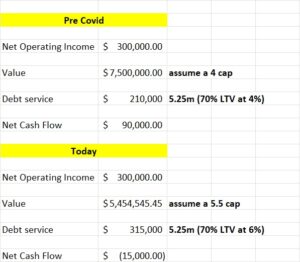

Below I put together a hypothetical analysis of what is occurring in the multifamily sector. Multifamily was trading at insanely low cap rates while at the same time banking on appreciating rents. As rents have stagnated or even declined in some markets and interest rates have basically doubled, many apartment deals no longer cash flow and are in trouble. Furthermore, it is more than likely that a bank holds the note below and that note is now a big problem for them. Here is a great article in the Wall Street Journal that shows how this is playing out in real life.

Remember most commercial loans are fixed for 3-5 years and then the rate resets to the market rate (typically 10 year treasury +). This scenario below is especially difficult:

- LTV using new cap rate is radically different: No lender today would provide a new loan with the cash flow basically at break even due to the higher rate.

- Cash flow underwater based on new rate: Assuming the note is current and the lender sold the note, a substantial discount would have to be given to compensate for the ultra-low rate.

- Even if note is held and renewed a substantial loss would have to be taken by the bank for impairment

| Pre Covid | ||||

| Net Operating Income | $ 300,000.00 | |||

| Value | $ 7,500,000.00 | assume a 4 cap | ||

| Debt service | $ 210,000 | 5.25m (70% LTV at 4%) | ||

| Net Cash Flow | $ 90,000.00 | |||

| Today | ||||

| Net Operating Income | $ 300,000.00 | |||

| Value | $ 5,454,545.45 | assume a 5.5 cap | ||

| Debt service | $ 315,000 | 5.25m (70% LTV at 6%) | ||

| Net Cash Flow | $ (15,000.00) | |||

Is the recent decline in commercial property values a blip or a trend?

“Lots more price declines are coming,” Mark Zandi, Moody’s Analytics chief economist, said.

The danger is that will compound the difficulties confronting many banks at a time when they are fighting to retain deposits in the face of a steep rise in interest rates over the past year.

Excluding farms and residential properties, banks accounted for more than 60% of the $3.6 trillion in commercial real estate loans outstanding in the fourth quarter of 2022, with smaller institutions particularly exposed, according to the Federal Reserve’s semi-annual Financial Stability Report published last week.

“The magnitude of a correction in property values could be sizable and therefore could lead to credit losses” at banks, the report said.

Summary

The recent declines in commercial properties are not a blip. They are the beginning of an upcoming cycle with huge resets in prices. These prices will be most profound in office with big impacts also being felt in larger multifamily.

Based on the current federal reserve predictions, rates will remain elevated at least until around mid-year 2024. This will exasperate the issue new group of office and multifamily notes come due for a reset leading to cash flow issues in many cases.

The overwhelming majority of commercial loans are held by banks so at the end of the day someone will be taking a haircut that will become self-fulfilling as lenders sit out on new deals due to their own cash flow issues caused by commercial property. I’m already seeing the credit crunch which will get amplified over the next year with higher rates.

Additional Reading/Resources

- https://www.costargroup.com/costar-news/details/mixed-performance-in-the-latest-costar-composite-price-indices

- https://www.bloomberg.com/news/articles/2023-05-17/us-commercial-real-estate-prices-fall-for-first-time-since-2011?srnd=premium

- https://www.wsj.com/articles/a-housing-bust-comes-for-thousands-of-small-time-investors-3934beb3?mod=hp_lead_pos7

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender