by Glen | Sep 29, 2025 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Foreclosure, Georgia hard money, Government Bailout, Housing Price Trends / Information

With fluctuating mortgage rates and economic pressure in the housing market, foreclosure activity Has continues to ramp up throughout the year. According to real estate data provider Attom, homebuyers may face more challenges heading into 2025. Why are foreclosure...

by Glen | Sep 8, 2025 | 2025 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, best real estate investment, Colorado Hard Money, Denver Hard Money, Denver private Lending, Denver Real Estate Trends, General real estate financing information, Georgia hard money, Hard Money Lending, Housing Price Trends / Information

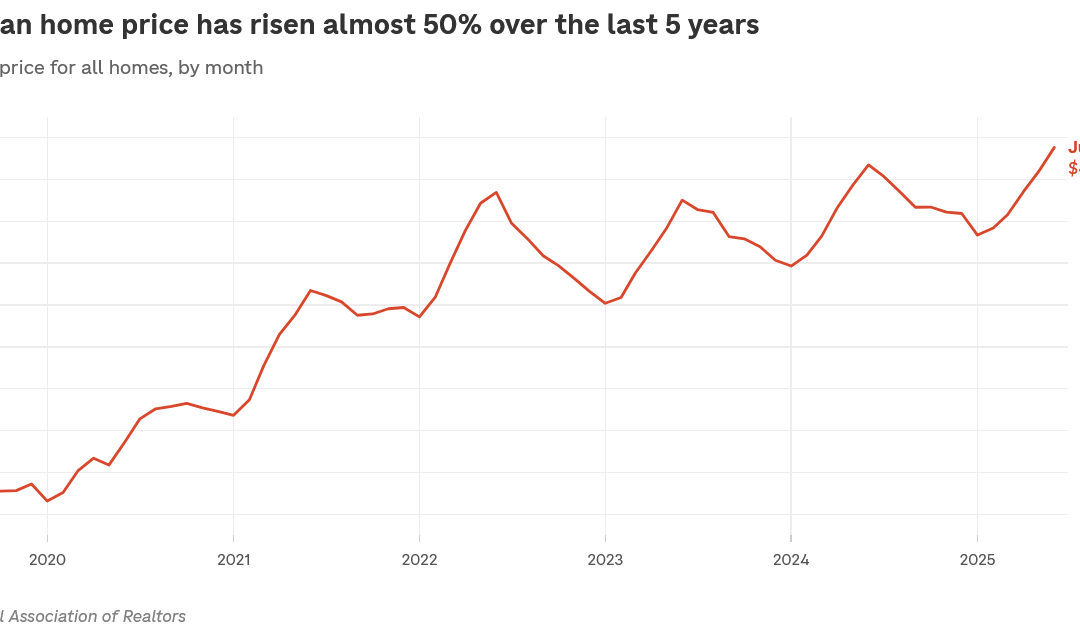

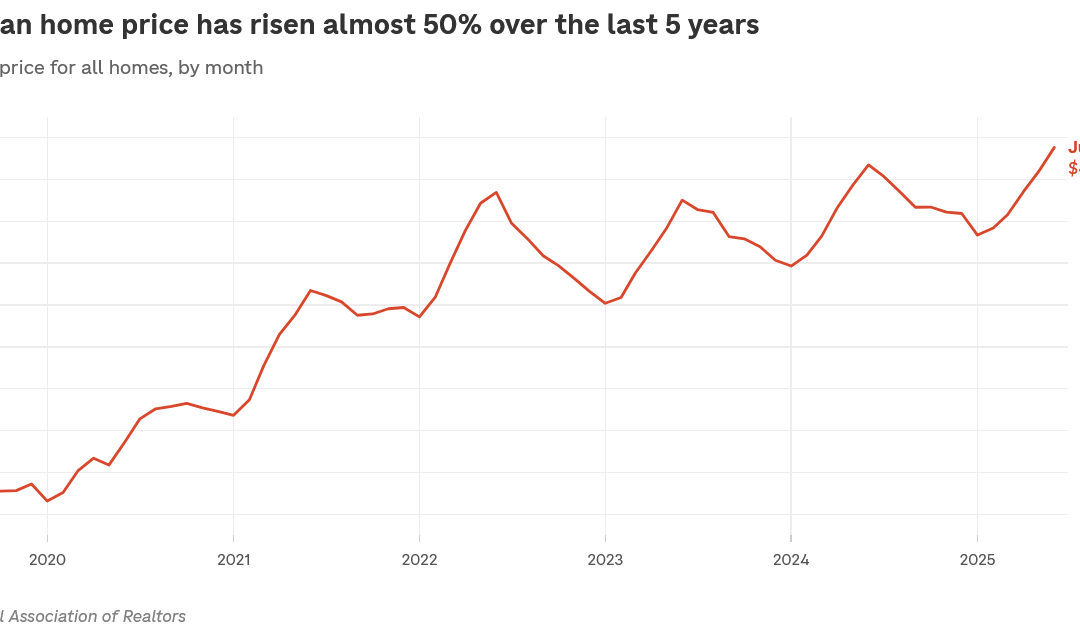

Check out the chart above. House prices this summer have hit yet another record? On the flip side, look at the chart below of Denver and Atlanta. Why the huge difference? What is happening in today’s real estate environment? Is the data above or below...

by Glen | Aug 25, 2025 | 2025 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, best real estate investment, Colorado Hard Money, Colorado private lender, Colorado rent control, Denver private Lending, Denver Rent Control, Georgia hard money, hard money, Housing Price Trends / Information, war on landlords

Since Covid, Landlords have been portrayed as the big bad wolf and the root cause of pretty much any housing woe you can think of. Legislatures have jumped on the bandwagon essentially declaring war on landlords with the number of tenant laws doubling in three...

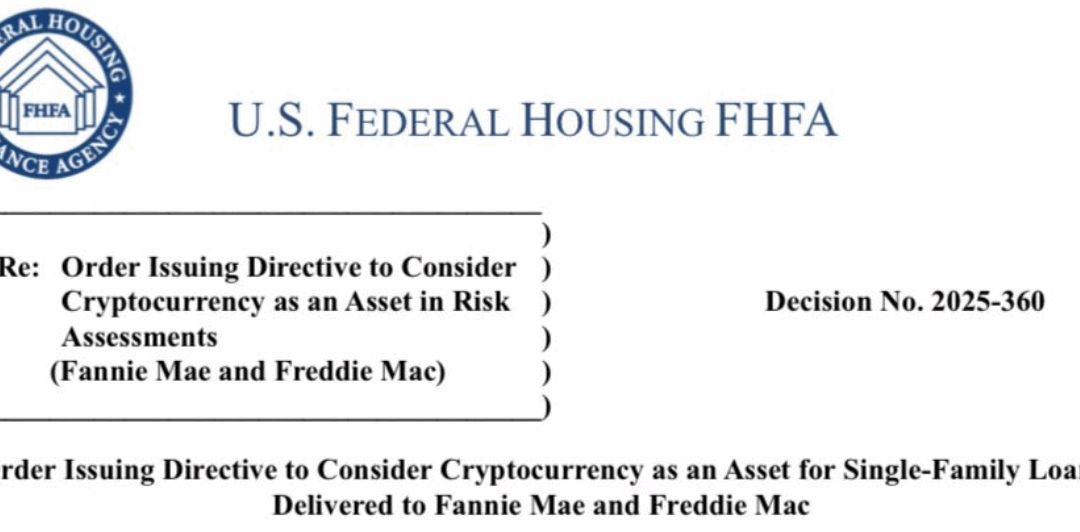

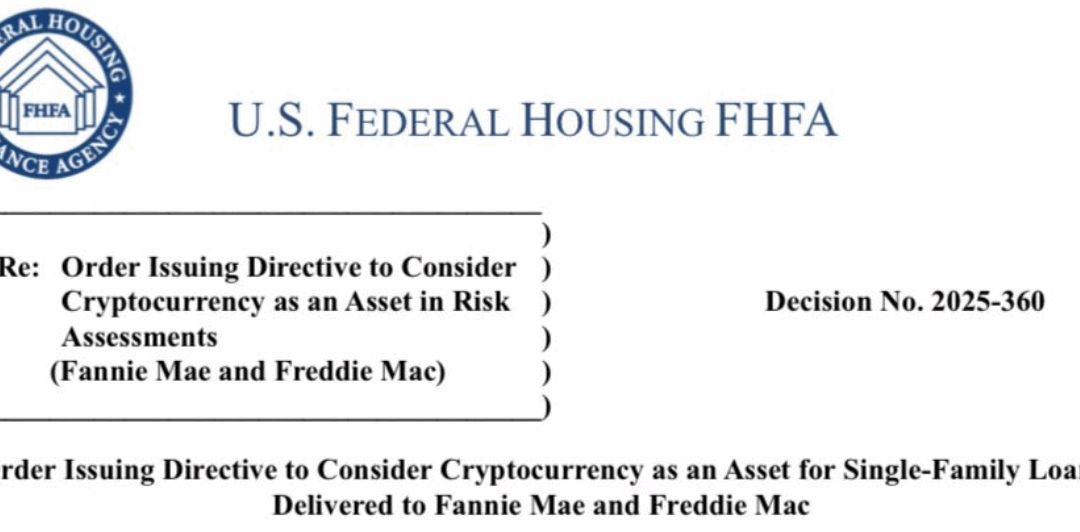

by Glen | Aug 18, 2025 | Atlanta Hard Money, Colorado Hard Money, Colorado private lender, Cryptocurrency real estate, Denver Hard Money, Georgia hard money, hard money, Hard Money Lending, Housing Price Trends / Information

Fannie Mae and Freddie Mac, the largest buyers of mortgages, effective immediately are required to count cryptocurrencies as an asset for mortgages. This is a profound shift in policy. How will this impact real estate lending? Will Cryptocurrency radically alter...

by Glen | Jun 9, 2025 | 2025 mortgage rates, 2025 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, hard money loans, Housing inflation, Housing Price Trends / Information

It is interesting that inventory is increasing, demand is declining, and yet home prices are staying relatively stable and or increasing based on the latest data from the National Association of Realtors. How accurate is this data? What alternative metric...

by Glen | Jun 2, 2025 | 2025 mortgage rates, 2025 real estate predictions, Atlanta Hard Money, Colorado Hard Money, Commercial Lending in the news, Commercial Lending valuation, Denver Hard Money, Georgia hard money, Hard Money Commercial Lending, Housing Price Trends / Information

Rocket Mortgage announced the acquisition of Mr. Cooper mortgage, the largest loan servicer in the US, which will now service 2.1 trillion dollars in loans and the combined company will have access to over 10 million combined clients. Will this lead to a 2/3...