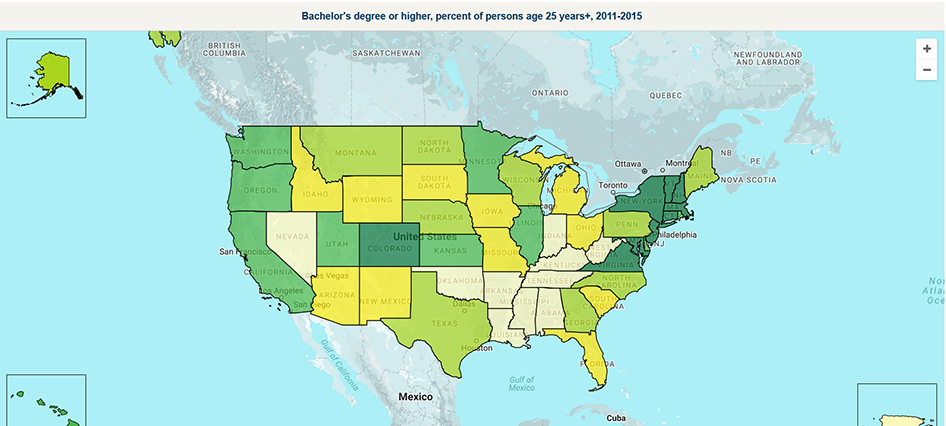

The map above is the most important picture for Real Estate Profitability. What does it signify? What do the dark green areas mean? A recent article in the Wall Street Journal stated 19 million jobs will be eliminated in the next 15 years, but 21 million new jobs will be created. This sounds great, a net gain of 2 million jobs. The problem is the new jobs are radically different than the old jobs and will be “clustered” in new locations. The skills needed for past employment are not the same as those for the “new economy” jobs.

In the past jobs were driven by manufacturing & extractive industries (coal, oil, etc…). Today’s job picture is vastly different. The new economy is now driven by technical industries (software, financial, healthcare, etc…). The new industries pay well and require a highly educated workforce.

Why is this economic shift important?

The past locations that focused on the old economy jobs will not be applicable in the future. Just as old manufacturers used to congregate in certain areas. For example, the heavy manufacturers of the rust belt all used to focus on certain areas. Knowledge industries are similar in that they feed on themselves and concentrate in certain areas like Denver’s front range or silicon valley. It is a self-fulfilling prophecy; new companies will form near existing knowledge companies to access resources, knowledge about industry trends, and specific talent.

The premier example is Seattle, Washington. Seattle was a crime ridden old industrial town until Microsoft relocated there. Hundreds of other companies were created as a result which further attracted other companies like Amazon. The same is happening in Denver’s front range where knowledge companies spawn further innovation companies to form/relocate to the area. This trend appears to be gaining more steam. For example, the Denver front range is has attracted employers like Google, Oracle, Webroot, Homeadvisor, etc… Atlanta is having a similar technology awakening.

Why do jobs matter? Jobs are the best predictor of economic prosperity. They drive the entire local economy including real estate. The healthier the jobs economy the more prosperous an area is. The areas attracting jobs are increasing populations due to jobs.

In the picture, the darker the green area, the more highly educated a local workforce. The more educated a workforce, the greater probability of attracting the new “knowledge” industries. This explains why the state of Georgia is more prosperous than Alabama. The state look only gives one snapshot.

We all know real estate is local!

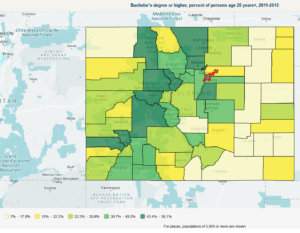

How can you predict which areas within a state will have a higher probability of success? I reluctantly have to give a shout out to the census department of United states government. They created a simple tool (link to census data) that allows you to drill down to the county level within a state to see the education level.

This is where you can really see the stark differences in Colorado between areas the dark areas are clustered around the front range near Denver and in the various mountain communities. Much of the state is left out of the new economy. The areas in lighter shades have struggled economically since the last recession and have never quite come back. Many of these areas may never relive their glory days as population follows jobs to the darker shaded areas.

Is this theory about jobs correct?

Below is a list of the top 100 tech companies in Colorado. Do you see the similarities with the county map? It jumps off the page that the darker green areas have attracted almost all of the tech talent.

What should you do?

Identify “knowledge clusters” within the markets you are investing (if there are none, invest elsewhere). The census data is invaluable to help predict the areas that will continue to grow at the county level. The darker the green is where you should focus your energies and shy away from lighter areas, their growth prospects will be limited.

Resources/ Additional reading:

- https://www.wsj.com/articles/how-the-robot-revolution-could-create-21-million-jobs-1510758001

- https://www.census.gov/quickfacts/fact/table/US/PST045216

- https://coloradohardmoney.com/2017/11/26/what-colorado-city-will-grow-fastest/

I need your help!

Don’t worry, I’m not asking you to wire money to your long lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles it would be greatly appreciated.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games).