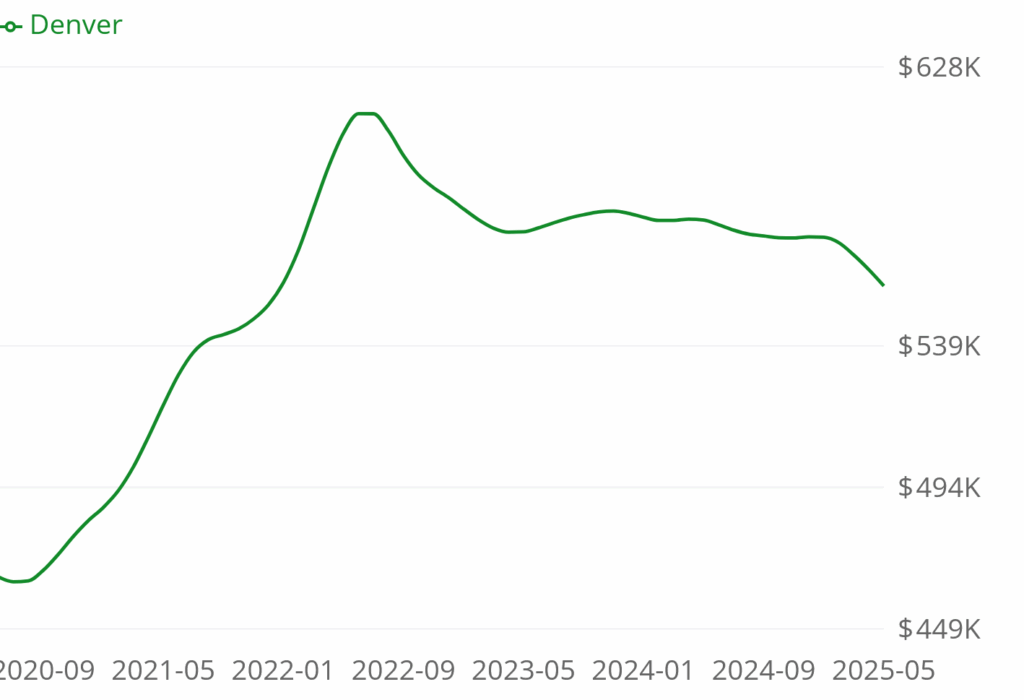

The real estate market has drastically shifted. Look at the chart above, sellers are rapidly outpacing buyers which means only one thing; the law of economics will rule, and prices will fall. What is causing prices to fall now in many markets, and will this accelerate? How much will prices fall, where will they fall the most, and when?

What was in the Redfin data?

“The balance of power in the U.S. housing market has shifted toward buyers, but a lot of sellers have yet to see or accept the writing on the wall. Many are still holding out hope that their home is the exception and will fetch top dollar,” said Redfin Senior Economist Asad Khan. “But as sellers see their homes sit longer on the market and notice fewer buyers coming through on tour, more of them will realize that the market has adjusted and reset their expectations accordingly.”

Sellers are already gaining more data points on this front, and will likely face another reality check in the summer, when demand typically starts to slow. More than two of every five (44%) home listings in April had been on the market for 60 days or longer—the highest April share since 2020. Stale inventory is piling up in part because many sellers are overpricing their homes, using sky-high comps from the recent seller’s market that aren’t realistic today. In some cases, sellers are pricing high because they bought at the peak of the market and are trying to recoup their investment.

Why has residential real estate suddenly cooled off?

The residential market has been cooling for the last several years. Last year as rates remained high, transaction volume started to drop and the trend continued this year. We have also seen a surge in seller concessions the past 6 months which is another indicator of what we are now seeing. Long and short, although it feels like real estate suddenly is slowing, there have been tons of indicators pointing to what we are now seeing over the last 18 months.

Unfortunately, in real estate we see a snowball effect where the market begins moving quickly in one direction because buyers have more demand like we saw during Covid to now the inverse where there are way too many sellers compared to buyers driving the market in the opposite direction.

What cities are most at risk of falling prices?

The once hot pandemic cities like Denver, Nashville, Miami, etc… are now the top cities with more sellers than buyers. If I look at Denver, prices got far ahead of wages and with interest rates staying high it became unaffordable for many buyers. The same is happening in pandemic boom towns throughout the country

What property types will fall the most?

Single family homes seem to be holding up considerably better than condos. With the changes at the federal level to condo requirements (insurance, reserves, etc..) many complexes no longer qualify for conventional financing pushing condo prices down substantially. Although single family are performing better, they will also fall due to higher inventory.

Will real estate prices fall further?

Yes, we are just at the beginning of the price adjustment and we have yet to see the real decline in prices that will be coming down the pipe. The huge surge in inventory at the same time that demand is waning is creating a snowball effect of lower prices in many cities.

Will real estate prices return to 2020 levels?

My prediction is that many of the once hot cities will give up about 5 years of appreciation. Let’s look at Denver in particular. Median prices of single family homes are already down about 9% from their peak which means Denver could easily fall another 10-20 percent to return to 2020 levels.

| year | Median | |

| 2020 | 496000 | |

| 2022 | 659000 | peak |

| 2025 | 600000 | May |

| total appreciation to peak | 33% | |

| % left to fall | 17% | |

Why did I pick 2020 for values to fall to?

If I look at what has been driving the economy over the last 5 years, the primary driver has been government spending. This spending is through lower interest rates subsidizing the market, no student loan payments, subsidized healthcare, huge subsidies to state and local governments for schools, roads, mental health, etc… long and short the only real change in the economy the last 5 years has been driven by the government and not “real” economic value. This leads to the situation we are in where the government must cut back on spending as the bond market is forcing their hand with higher rates which is leading to some of the issues we are now seeing in real estate with mortgage rates staying much higher for longer.

Real Estate Values in for a reset the next 24 months

I’ve been saying for a while that values have gotten ahead of themselves. The huge government cash cow set the stage for the huge surge in values and now the subsequent reset in the market. I don’t see a 2008 repeat with real estate taking the economy down, but anyone who bought in the last 5 years will feel the pain if they must sell in the next few years.

Although a reset is never pleasant, over the last 10 years real estate has appreciated way faster than at any other time in history so it should not be surprising that some of the gains will be lost. Look for real estate to struggle for the next couple years as the huge influx of inventory must be absorbed.

One important note. I am painting the trends I am seeing very broadly, but as we all know real estate is hyper local. For example looking at Denver, parts of the suburban markets will drastically outperform the downtown market even though they are both considered Denver metro, and they are only a few miles away.

Additional Reading/Resources:

- https://www.redfin.com/news/sellers-vs-buyers-price-impact/

- https://www.fairviewlending.com/have-home-price-already-declined/

- https://www.fairviewlending.com/category/2025-real-estate-predictions/

- https://coloradohardmoney.com/will-colorado-real-estate-prices-fall-2025/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender, residential hard money lender, commercial hard money lender, No doc real estate lender