Fed raises rates 2200% The floor on housing prices drops

The real estate party cannot go on forever. We are in a goldilocks scenario where prices are staying high even in the face of doubling mortgage rates. Unfortunately, eventually the porridge cools off! It is not possible with the steep rise in interest rates that there is not a misstep in the economy. Will the billions in Wall Street money sitting on the sideline waiting for a reset keep housing prices high? Why is the “floor” on real estate prices dropping?

This real estate cycle is radically different than 2008

This real estate cycle has some stark differences with 2008 and other prior cycles. Typically the federal reserve raises rates quickly to contain runaway growth and inflation. In this cycle, the federal reserve waited about a year too late before tapping the brakes which has allowed inflation and consumer spending to become entrenched.

Even as the federal has raised rates from .25% to 5.5% consumers keep buying cars, trips, etc…. keeping inflation well above the federal reserve target. This strong consumer spending and high inflation changes this real estate cycle.

If we rewind to 2008 along with prior cycles, there was typically some event that led to a reset in prices. In 2008, the raising of interest rates and large quantities of adjustable rate mortgages led to an enormous drop in real estate prices and a subsequent decline in employment. The Federal reserve was then able to drop interest rates to help the economy recover.

In this cycle, with inflation running well above targets, dropping rates quickly is not in the cards as the goal is a “soft landing” where employment stays high and consumer spending does not pull back enormously. Under this scenario interest rates stay much higher for considerably longer as the federal reserve will be hesitant to drop rates to early as inflation could reaccelerate.

Wall Street money puts a floor under real estate

I’ve said for a while that wall street buyers in this real estate cycle would put a “floor” under real estate prices as they deploy billions in capital. Essentially the theory is that as real estate prices fall, big investment firms like Blackstone and countless others will “feast” on lowered real estate prices as they can buy huge quantities of single family homes for long term rentals. As they deploy capital this will put a “floor” under real estate prices as their demand will halt too far of a drop in prices.

Federal reserve has changed where the floor is

As mentioned above, in this cycle we will not see a huge drop in interest rates quickly. As interest rates remain high, the return on Capital that is required also remains high. For example, if the federal funds rate stays at 5%, basically the risk free rate of investing, then investors will demand a higher rate of return for taking risks. In this case an investor will require a higher return. For example they would require a 6 % return or they could invest in other assets like the mortgage market with interest rates on 30 year loans north of 8% (as of this writing).

This rate of return is also known as the capitalization rate (cap rate) in commercial properties. As wall street firms buy properties they are analyzing them based on their rate of return.

Remember the higher the cap rate the lower the price of the property is (inverse). We are seeing this play out in real life. Invitation, which owns about 83,000 houses, has been selling properties that have appreciated to the point that they are yielding less than 4% and putting the proceeds in the bank, where the cash is earning more than 5%. (Wall Street Journal)

Prices have to fall substantially more in order to hit the floor

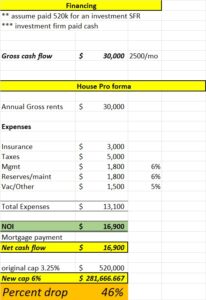

With rising interest rates this means cap rates have increased substantially. As cap rates remain high the only solution to hit the rate of return is for prices to fall. Below is an example of of how prices will for a single family home will be impacted by rising cap rates.

As you can see it will take a big price adjustment to get wall street money to move off the sidelines with interest rates remaining high.

Will prices really fall as much as the model above predicts?

I find it highly unlikely that we will see retail prices of homes fall 46% as this would put us on par with 2008 which is not in the cards at this point. But, there will still be a drop in the 5-15% range is most probable. At the same time large investors will focus on buying huge pools from banks, the FDIC, etc… as the financial sector hits headwinds.

Summary

Before this recession, I thought that Wall street would put a floor under prices so that they didn’t fall too far. Unfortunately in a high rate environment this assumption has been turned on its head. Based on interest rates staying higher for longer this means that Wall Street will not bail out the housing market until prices fall considerably (40% or so to make the returns work). Although I don’t foresee a drop this steep, it does portend that the market will be able to fall quite a way before Wall street comes to the rescue.

Currently my base case is a 5-15% drop depending on market, price point, etc… but I don’t see a 2008 repeat in the near future. The wild card is how high the federal reserve needs to take rates and how long they have to hold them high before something bad breaks in the economy. So far, it looks like a moderate recession, but as with anything in economics, there are a ton of variables that could radically alter this assumption. In the meantime, I’m confident prices will have a reset in early 2024 due to higher rates so plan accordingly.

Additional Reading/Resources

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender