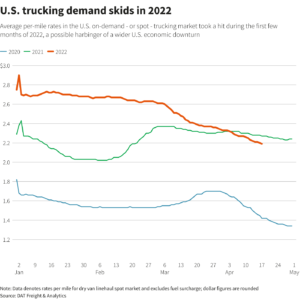

There has been an unexpectedly sharp downturn in demand to truck everything from food to furniture since the beginning of March and rates in the overheated segment that deals in on-demand trucking jobs – known as the spot market – are skidding. Why are trucking rates suddenly falling fast? What does this mean for the economy and in turn real estate?

What was in the data regarding trucking spot rate prices?

March is typically a strong month for trucking, as shippers start to stock their shelves in preparation for summer. And late March normally gets a reliable end-of-quarter boost in volumes as shippers pump sales and reduce inventories. This year, we are not seeing that surge. In fact, March volumes are softer than at any point in 2021 (other than holidays).

Rates on trucking’s spot market are sliding and analysts have started to downgrade companies in the sector as truckers prepare to report first-quarter earnings in a market that is signaling growing economic uncertainty.

The Cass Freight Index measure of domestic shipping demand edged up a bare 0.6% in March from the year before and up 2.7% from February, an unseasonable slow growth rate at the end of the quarter. Freight-payment company Cass Information Systems Inc. said in an analysis of its closely watched index that the freight market is clearly in a slowdown.

Bank of America’s measure of trucking capacity available to shippers jumped last week to its highest level since June 2020, while its measure of shippers’ outlook for freight rates dropped sharply to the lowest level since July 2020.

Why is it important to watch the trucking price index?

History has proven trucking to be a possible indicator for the U.S. economy. That is because when people buy less, companies ship less – and business activity slows. Trucking is a far leading indicator of possible economic turmoil in the next 6-12 months.

Furthermore, economic recessions followed most trucking recessions since 1972, according to an analysis by trucking data company Convoy.

Migration from Goods to Services?

After two years of massive consumption of physical goods, consumers are pausing their spending. The COVID surge is largely behind us, and people are starting to shift their spending away from physical goods to travel and entertainment. This will take a much larger percentage of disposable spending than we have seen over the past two years.

I thought that the trend from goods to services would have started last year, but it is taking longer than expected to reverse itself. For example, consumer spending data confirms that a material shift is just now taking place. February retail sales were nearly flat at 0.3%, missing expectations (CNBC). Furthermore, appliance demand is also waning with Whirlpool warning that growth will be flat at best for the year.

What do falling truck rates mean for real estate?

The sharp drop in trucking rates is a leading indicator of a change occurring in the economy. As consumers shift more resources to services over goods, housing will be impacted as well. The “nesting” phase of covid is over and trucking rates are highlighting these swift changes as consumers venture out to restaurants and on vacations. As more income is spent on services, there are less available funds for housing. We are already seeing the impact of the shift to services along with rising interest rates in housing.

According to a Fannie Mae report, “we expect both home sales and home price growth to decelerate considerably this year. A meaningful decline in home sales often points toward downturns in economic cycles, as housing is interest rate sensitive and usually leads general turns in the economy.”

Summary:

Although you should now be able to get the appliance you’ve been waiting two years for, slowing freight is an indicator of a bumpy ride ahead for the not only the economy, but also housing. As the purchase of goods slow, housing will also slow as more funds are diverted to vacations and other services. We haven’t yet seen the impact from this change, but Fannie Mae and others are predicting a rapid slow down in housing the later part of this year and even more turmoil heading into 2023. As trucking hits the brakes, take note as housing is the next shoe to fall.

Additional Reading/Resources

- https://www.wsj.com/articles/trucking-boom-is-hitting-the-brakes-as-freight-demand-slows-11649881003

- https://www.reuters.com/business/us-trucking-downturn-foreshadows-possible-economic-gloom-2022-04-25/

- https://www.overdriveonline.com/business/article/15290659/rates-down-fuel-up-is-a-trucking-bloodbath-on-the-way

- https://www.freightwaves.com/news/why-i-believe-a-freight-recession-is-imminent

- https://www.freightwaves.com/news/just-three-years-after-2019s-trucking-bloodbath-another-one-is-on-the-way

- https://www.reuters.com/business/ups-adjusted-profit-rises-e-commerce-demand-2022-04-26/

- https://www.wsj.com/articles/whirlpool-says-consumers-appliance-demand-is-waning-as-costs-mount-11650924164?st=dvf04syulqvi4c4&reflink=share_mobilewebshare

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender