There is a tidal wave of distressed homeowners who will need help,” Dave Uejio, the CFPB’s acting director, said in a statement; companies “that are unable to adequately manage loss mitigation can expect the bureau to take enforcement or supervisory action.” At the same time the mortgage market is humming getting approved for a home loan is as difficult as it has been in years. Will this lead to more foreclosures? What does this mean for real estate and lending? Where will the mortgage defaults be?

Tidal wave of distress coming to the housing market

The Consumer Financial Protection Bureau warning is tied to forbearance relief that has allowed millions of borrowers to delay their mortgage payments due to the pandemic. To avoid what the bureau called “avoidable foreclosures” when the relief lapses, mortgage servicers should start reaching out to affected homeowners now to advise them on ways they can modify their loans.

“There is a tidal wave of distressed homeowners who will need help,” Dave Uejio, the CFPB’s acting director, said in a statement. “Servicers who put struggling families first have nothing to fear from our oversight, but we will hold accountable those who cause harm to homeowners and families.”

In a separate compliance bulletin released Thursday, the CFPB said that companies “that are unable to adequately manage loss mitigation can expect the bureau to take enforcement or supervisory action.” Accordingly, the Bureau intends to consider a servicer’s overall effectiveness at achieving such goals, along with other relevant factors, in using its discretion to address violations of Federal consumer financial law in supervisory and enforcement matters.

More than 2 million borrowers as of January had either postponed their payments or failed to make them for at least three months, the bureau said. Once government-authorized forbearance plans begin to end in September, hundreds of thousands of people may need assistance getting back on track.

Banks cut lending to lowest level in 7 years

The compliance bulletin was a threat to lenders that they will be “judged” harshly if there are allot of foreclosures in their portfolios. Banks got the memo and will take aggressive actions to avoid becoming the target of the CFPB.

It is not coincidental that banks are pulling back on lending. My dog can figure out that if she wants a treat she must sit nicely and wait for it. Banks got the memo loud and clear. To ensure they do not become the target of the CFPB, they pulled back on loans to riskier borrowers to greatly eliminate the prospect of foreclosures.

Mortgage credit availability, a measure of lenders’ willingness to issue mortgages, is near its lowest level since 2014, according to the Mortgage Bankers Association, or MBA.

The tight lending environment illustrates a growing schism in the mortgage market: More home loans are being made than almost ever before, but they are going almost exclusively to borrowers with pristine credit histories and sizable down payments.

Borrowers with credit qualifications that fall just outside the stellar category are finding fewer lenders willing to approve their applications. A segment of borrowers who would have qualified for a home loan early last year are now out of luck, deemed too much of a credit risk.

Foreclosures will pick up/ Impact on real estate

Regardless of what the CFPB says, there will be many foreclosures once the foreclosure moratoriums expire. On average, there are three million plus borrowers in forebearance. Unfortunately, at least half of these homeowners will ultimately default and 1.5 million properties will hit the market.

Fortunately, there is large demand in most markets that will quickly absorb the coming inventory. I don’t see much, if any, impact on prices.

Summary

The objective of the CFPB guidance was to prevent foreclosures. Unfortunately, their memo/threats will have a negligible impact on the pending foreclosure “tidal wave”. The moratoriums on foreclosures have merely delayed the inevitable for many borrowers. The irony is that the new CFPB policy could actually lead to an increase in foreclosures as banks pull back on making loans to those that need it the most. Fortunately, the market has plenty of pent-up demand to quickly absorb this inventory so real estate prices will have a negligible impact.

Additional Reading/Resources

- https://www.bloomberg.com/news/articles/2021-04-01/mortgage-firms-warned-to-prepare-for-a-tidal-wave-of-distress?srnd=premium

- https://www.wsj.com/articles/the-mortgage-market-is-roaring-but-lots-of-people-cant-get-a-loan-11617355802?mod=mhp

- https://www.cnbc.com/2021/02/16/eviction-and-forbearance-protections-extended-for-homeowners.html

We are still Lending as we fund in Cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

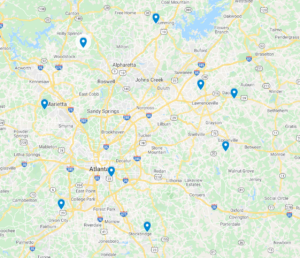

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).