The jobs report last week was a welcome surprise beating expectations with 266k jobs created, almost 50% more than expectations. This is the lowest jobless rate since 1969 underpinning a strong consumer that continues to spend and drive the bull market. What does the chart above tell us? What does this mean for real estate?

Why did the economy not slip into recession?

Surprisingly the Federal Reserve acted early enough in the cycle to aggressively lower interest rates. This effectively made money cheaper with lower mortgages, car rates, credit card rates, etc.. which enabled the consumer to keep spending. The consumer has been the largest driver of this economic cycle and their perception of the economy continues to outperform any economic prediction. Consumer sentiment continues at record highs which is driving purchases.

Will this bull market continue?

This is the million-dollar question. How long can this record bull market continue? I, like many others, have been pleasantly surprised by the resiliency of the American consumer. The Federal reserve has done a great job using monetary policy to prolong this economic expansion. Unfortunately, at some point the “sugar high” from lower rates will wear off. The chart below can provide some insight into when this might occur

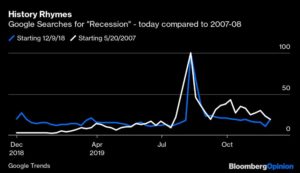

What insight can we gain from the search on Google of “recession”?

In August 2019, the search for the term “recession” hit a peak on Google just as the yield curve was inverting and the trade war was heating up. This pessimism quickly evaporated with the search term recession falling to new lows. Has the recession really been avoided? Pessimism about a recession has evaporated after reaching a peak — just like it did before the financial crisis. The chart above (source Bloomberg) should give everyone some pause. How does this compare with 2008? The trend lines above look strikingly similar. We quickly found out in 2008 that searches for the term recession peaked around August of 2007 before falling off precipitously. Officially the last recession began around December of 07. This is about 5 months lag to when the recession officially started.

When will the recession hit?

Unfortunately, we don’t have much history on Google search terms as the data only goes back to 2005 so we can only look back to the last recession to try to make assumptions. If we combine the data from google with the history of the yield curve it puts the next recession into late 2020 to mid-2021. Historically a yield curve precedes a recession by 12-24 months

What does this mean for real estate?

Real estate in most markets have already started to factor in some sort of economic change as once hot markets like Denver, Atlanta, Portland, and Seattle are cooling quickly with prices staying relatively flat. It is pretty interesting that consumer sentiment is at the highest in a decade, but for whatever reason consumers are pulling back on their largest purchase decision, real estate. Is the consumer firing off a warning shot by the cooling of the housing market?

Summary

Although the jobs report was great and consumer confidence continues to power the economy, I wouldn’t pop the bubbly just yet. Searches on Google and the inversion of the yield curve are giving a radically different answer with a recession just starting to brew. Although the storm is still far out and could change course, the signs are pointing to trouble brewing on the horizon late next year.

Additional Reading/Resources

- https://www.usatoday.com/story/money/2019/12/08/dow-jones-jobs-report-extends-bull-market-stocks/4373873002/

- https://www.cnbc.com/2019/12/06/us-nonfarm-payrolls-november-2019.html

- https://www.ccn.com/google-searches-for-recession-just-hit-a-scary-high/

- https://www.bloomberg.com/opinion/articles/2019-12-10/recession-fear-google-trend-has-echoes-of-2008-crisis-k3zedlta?srnd=premium

- https://www.bloomberg.com/opinion/articles/2019-12-08/goldilocks-just-right-economy-may-be-too-good-to-be-true

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games).