While in other countries real estate is slowing, home price growth in 20 US cities picked up for the fourth straight month with Tampa, Florida, showing the biggest gains. March’s reading was the highest year-over-year price change in more than 35 years of data, with the 10-City growth rate at the 99th percentile of its own history. Will this appreciation continue? What happens next? How do the US housing prices impact the federal reserve and in turn interest rates?

What was in the data regarding home price appreciation?

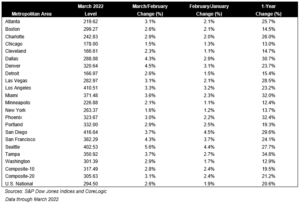

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 20.6% annual gain in March, up from 20.0% in the previous month. The 10-City Composite annual increase came in at 19.5%, up from 18.7% in the previous month. The 20-City Composite posted a 21.2% year-over-year gain, up from 20.3% in the previous month. Furthermore the national average appreciation was 20.6%.

Tampa, Phoenix, and Miami reported the highest year-over-year gains among the 20 cities in March. Tampa led the way with a 34.8% year-over-year price increase, followed by Phoenix with a 32.4% increase, and Miami with a 32.0% increase. Seventeen of the 20 cities reported higher price increases in the year ending March 2022 versus the year ending February 2022.

March’s reading was the highest year-over-year price change in more than 35 years of data, with the 10-City growth rate at the 99th percentile of its own history.

Will the torrid pace of home price appreciation continue?

I’m doubtful that appreciation will continue anywhere near the current pace. Rates are rising on top of rising prices which ultimately will price out a substantial number of buyers. Furthermore inflation is running hot so incomes are not going as far further crimping already stretched prospective home buyers.

We are already seeing inventory start to increase which will ultimately slow down future appreciation. For example, Redfin Corp. said earlier this month that the number of sellers cutting prices hit the highest level since October 2019. We haven’t seen this reflected in the data yet but we should see a considerable slowdown in the next 60 days or so.

Federal reserve impact and interest rate impact from continued home appreciation

Continued home appreciation is a double edged sword. The current appreciation greatly benefits existing home owners, but the other side of the sword is that the overall economy continues to heat up due to rising inflation.

It is important to note that rents ultimately reflect prices. As prices rise, rents must rise for property owners to make a return on their investment. As prices jump 34%, rents will ultimately jump higher as well. There is typically a lag effect where it could take 6 months to a year for rents to catch up. Even if prices slow, which they should, there will still be considerable rent increases in the next 6-12 months which will ultimately impact inflation.

Housing makes up around a third of the consumer price index so rising home prices will have a large impact on inflation. As the federal reserve is working to bring down inflation, rising house prices makes their job considerably harder.

Higher house prices and in turn inflation will force the federal reserve to continue hiking rates to combat inflation. Ultimately, higher rates will increase mortgage rates and eventually slow the housing market and future appreciation.

Summary

Although higher house prices are a boon to existing property owners, the general economy will suffer as higher prices lead to higher inflation via rent. This in turn will force the federal reserve to increase mortgage rates faster and higher than they had hoped to bring inflation back down. Inflation is now running at 8%, the federal reserve targe is 2%, house prices jumped on average 20% which means rents are going up and inflation is not even close to over. It doesn’t take a math wiz to see that if 30% of the consumer price index rises 20%, then it is going to take considerably higher interest rates to ensure inflation falls to 2%.

Additional Reading/Resources

- https://www.bloomberg.com/news/articles/2022-05-31/us-home-price-appreciation-accelerates-for-fourth-month?srnd=premium

- https://www.spglobal.com/spdji/en/index-announcements/article/sp-corelogic-case-shiller-index-reports-annual-home-price-gain-of-206-in-march/

- https://www.cnbc.com/2022/05/31/home-prices-surged-in-march-as-interest-rates-also-rose-sp-case-shiller.html

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender