Although all eyes and media coverage was on the supposed “blue wave” on election day, the real story are the huge changes in property rights throughout the Country. Did Nantucket vote to continue an effective ban on nightly rentals? Did Vail pass a 17% tax on nightly rental stays? Did voters in NY effectively take away property rights with the new mayor? What city benefited 100m from the election? The outcomes of each election were surprising and will have far reaching consequences for property owners.

Property rights were clearly on the ballot this election with three major elections throughout the country that could drastically alter property rights.

- Nantucket: This is a pricey resort/tourist destination. There was recently a ruling where a judge found that Nantucket’s zoning bylaw “does not allow short-term rentals as a principal use of a primary dwelling,” effectively rendering many vacation rentals on the island illegal overnight. This led to an election fight over nightly rentals.

On Election Day 2025, the people of Nantucket responded: In a vote during a Special Town Meeting on the evening of Nov. 4, Article 1—legalizing STRs across the island—passed with 71 percent support. The vote cleared the two-thirds threshold needed for adoption. This vote nullified article 2 which would have allowed short term rentals but with more restrictions on length of stay, number of days you could rent, etc… Although Article 2 failed, look for it to come back in future elections as the dust settles from the reinstatement of nightly rentals

- Vail, Colorado: There were two initiatives on the ballot, one at the county level (eagle county) and one at the city of Vail.

-

- Eagle County nightly rental taxes (PASSED): Ballot measure 1A: SHALL EAGLE COUNTY LODGING TAXES BE INCREASED BY $4,500,000 ANNUALLY COMMENCING ON JANUARY 1, 2026, AND BY WHATEVER ADDITIONAL AMOUNTS ARE RAISED ANNUALLY THEREAFTER, BY INCREASING THE LODGING TAX RATE FROM TWO PERCENT (2%) TO FOUR PERCENT (4%), SUCH TAX TO BE LEVIED ON THE RENTAL FEE, PRICE, OR OTHER CONSIDERATION PAID OR CHARGED FOR THE LEASING, RENTAL,SALE OR FURNISHING OF A ROOM OR ACCOMMODATION FOR A SHORT- TERM PERIOD OF LESS THAN THIRTY (30) CONSECUTIVE DAYS

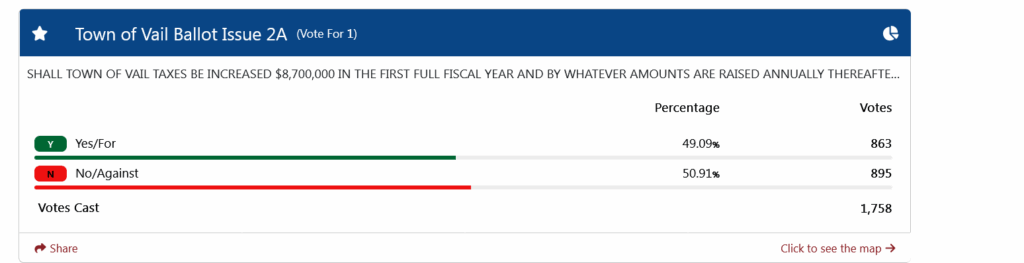

- City of Vail (FAILED BY 30 VOTES): Ballot measure 2A: SHALL TOWN OF VAIL TAXES BE INCREASED $8,700,000 IN THE FIRST FULL FISCAL YEAR AND BY WHATEVER AMOUNTS ARE RAISED ANNUALLY THEREAFTER, BY THE LEVY OF A NEW TAX ON SHORT-TERM RENTAL ACCOMMODATIONS AT A RATE OF SIX PERCENT (6%) OF THE TOTAL CONSIDERATION PAID FOR SUCH ACCOMMODATIONS, TO TAKE EFFECT ON JANUARY 1, 2026. Note this would increase the accommodation tax to a total of 16.8% (currently the rate is 10.8%).

-

-

- On a side note, Airbnb had bankrolled the campaign to defeat this ballot initiative; I was very surprised that this initiative failed at the ballot box, but with how close it was, look for it to come back to life in an upcoming election.

-

- New York City Mayor’s race: With the election of Mamdami there will be huge changes to property rights in New York. Here are the key proposals:

- Rent freeze: A potential rent freeze on rent-stabilized apartments is a central part of his policy. Mamdani can influence this through appointments to the Rent Guidelines Board, which sets annual rent adjustments.

- Public housing investment: He proposes a large-scale public building campaign with a $100 billion “Housing By and For New York” plan to create affordable housing through a Social Housing Development Agency.

- Tenant protections: Mamdani advocates for strengthening tenant protections, which is intended to provide more stability for renters.

If you own property in NY city, brace for big changes that will substantially decrease property values from rent increases, tenant protections, and no doubt higher taxes on both income and property. The crazy part is that we already know how this is going to work out, look at what happened when NY restricted nightly rentals, rents still rose!

On a side note, Colorado has implemented huge tenant protections like Mamdami is proposing with disastrous effect on affordable housing. The NY policies will ultimately lead to lower prices, look at this analysis of Denver vs Salt Lake City after all the property tax laws in Colorado

The irony is that in every situation there is a winner and a loser, after the election realtors in south Florida have reported a surge in purchases from NY buyers getting out before the tax policies change. Developer Isaac Toledano, CEO of Miami-based BH Group, told Fox News Digital that his company has closed more than $100 million in signed contracts from New York buyers in just the past few months – about twice last year’s volume.

Property owners were the target of this election

Although the media keeps talking about the “blue wave”, the real story is that this election is about property rights in many states. New York city led the way by electing a “socialist” that is radically altering property rights and in many cases “taking” property rights by freezing rent, putting in onerous tenant protections, etc… basically implementing rent control throughout the city. This will not end well with basically all new construction slowing dramatically due to the uncertainty around property rights.

On the flip side, Vail barely defeated (by 30 votes) a proposal to increase short term lodging taxes to 17%, but Eagle county still implemented a 6% surcharge on nightly rentals which although it is a tax it will not dramatically alter the market like a 17% tax. Nantucket also affirmed property rights with 70% voting to allow nightly rentals after an interesting ruling had basically made all nightly rentals illegal.

Although there were some wins for property rights on election night, there appears to be a pervasive attitude in many areas to somehow put every single social woe on property owners, whether it is tourism, affordable housing, etc… somehow private property owners are being looked toward to solve every issue. This is a warning that certain cities/states will have larger impacts on property rights. Now is the time for property owners to be aware of where they are investing to fully account for the risk of huge policy shifts like we are seeing in NY.

Additional Reading/Resources

- https://www.wsj.com/lifestyle/travel/your-summer-weekend-in-nantucket-is-on-this-years-ballot-345d828f?

- https://www.realtor.com/advice/buy/nantucket-short-term-rental-battle/

- https://coloradohardmoney.com/big-questions-in-co-this-election-what-town-proposed-17-short-term-rental-tax/

- https://coloradohardmoney.com/are-politics-leading-to-lower-denver-house-prices/

- https://www.foxbusiness.com/media/nyc-election-fears-drive-100m-florida-real-estate-surge-nervous-new-yorkers-flee-south

- https://www.fairviewlending.com/ny-nightly-rentals-plummet-90-rents-skyrocket/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender, residential hard money lender, commercial hard money lender, No doc real estate lender