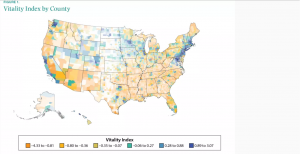

No, I’m not talking about democrats vs. republicans. I am talking about the actual color blue! Regardless of your political affiliations, I would recommend you only invest in areas on the map that are blue. The Brookings institute developed a map ranking the vitality of an area by county. Darker shades of blue have more vitality than other regions. What is “vitality”? Why is this so important for residential and commercial investing?

What is the “vitality index”

The Hamilton Project’s Vitality Index is a measure of a place’s economic and social wellbeing. It combines a county’s median household income, poverty rate, unemployment rate, prime-age employment rate, life expectancy, and housing vacancy rate. In this map, blue counties have higher vitality scores and yellow counties have lower scores. The vitality index is categorizing by county the areas with the strongest economies.

What is the largest driver of the “vitality index”

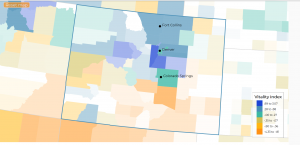

As soon as I saw the map, it looked eerily familiar to me. As I looked further, I went back to the census data to see which factor is the largest driver of the vitality index. If you look at the picture below of Colorado and compare that to the vitality index by county it is apparent that education level is the largest driver. You see clusters near the metro areas and then heading west into the ski resort communities. Not only do these areas have the highest vitality scores, but also the highest level of education.

This is not surprising as the US economy has transitioned from a manufacturing economy to a knowledge economy. For example, if you look at Amazon, they do not manufacture a product. They have created a software platform to resell goods ranging from toilet papers to trousers and everywhere in between. This trend to a knowledge economy will not only continue but accelerate.

Why is the vitality index more important now than ever in history?

For much of the 20th Century, the large gaps between regions were closing as poorer places grew faster, converging with higher income locations. Since around 1980, though, that convergence has stopped, leaving sizable gaps in economic outcomes across places. The net migration in the country has slowed, leaving areas with less vitality further behind. This trend will perpetuate itself as areas like Denver or Atlanta continue to attract companies which in turn attracts high quality employees that ultimately fill the local taxing authorities to enable them to invest in items that will attract even more companies (schools, roads, etc…) The same cycle occurs in inverse to areas with less vitality. As companies relocate to more promising areas, the tax base get smaller which prohibits substantial investment in the items that are likely to attract companies to return to an area.

Why is it critical to invest in the “blue” areas?

The areas in Blue will have the highest probability of continued economic success over the next 10-20 years as they are the most highly educated and well positioned to transform as the economy continues to shift away from manufacturing. This will be true for both residential and commercial prices as the two are intertwined. For example, as more residents relocate to an area, they will demand hospitals, restaurants, etc… which will drive up commercial values.

Note: When looking at the map, it is imperative to drill down in the state to the county level. Within a state, there can be radical differences in “vitality”.

Regardless of your political affiliations, on this map you want to be in the blue. The higher the vitality index the greater probability of success in real estate. This is especially important now as the economy is at a juncture. Will the economy keep roaring along or will the economic engine falter? History shows that all cycles eventually come to an end. By focusing on the areas with the highest vitality index you are stacking the odds in your favor regardless of the upcoming market cycle.

Resource/Additional Reading:

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games).