In my last blog post, Will real estate fall to 2020 values, I launched my first survey to see what the readers of my blog thought about the direction of the real estate market, the results were astounding. There was a clear consensus of where real estate prices are heading. Thank you to everyone for your responses; your insight it is invaluable. Below are the insights from the survey.

About my email list

My email list is large and all organic that includes realtors, appraisers, property owners, assessors, various real estate media, etc… It is a diverse group from a realtor in Atlanta,GA focusing on 400k houses to a realtor in Aspen or Telluride, CO that just sold a 40 million dollar home. The viewpoints are diverse based on geography, specialization within real estate (title company versus commercial property owner), etc… This allows a unique cross perspective on real estate trends. The insights from this list are astounding as there are some extremely bright people who have unique perspectives.

What was the question in the survey?

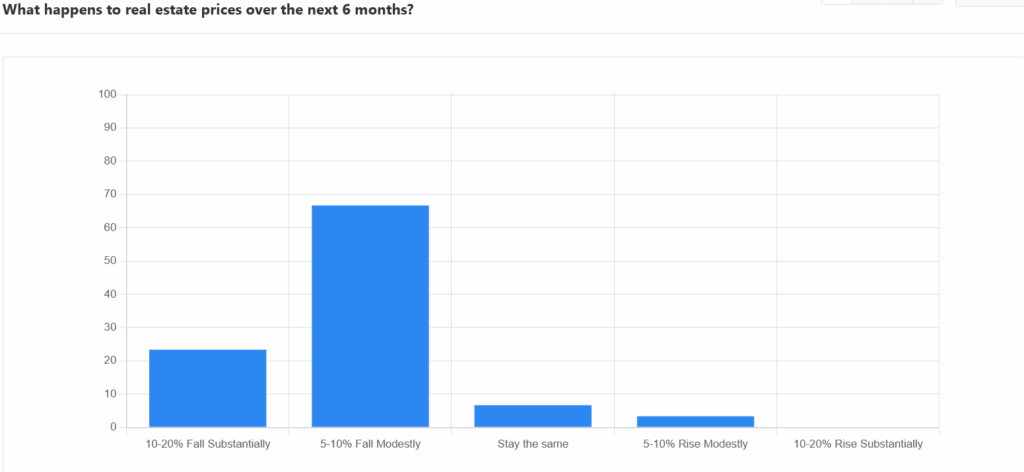

What happens to real estate prices over the next 6 months?

- 10-20% Fall Substantially

- 5-10% Fall Modestly

- Stay the same

- 5-10% Rise Modestly

- 10-20% Rise Substantially

Do you agree or disagree that real estate prices will reset; Why?

What were the results from the survey?

I was amazed at how resounding the responses were.

- 67% felt prices would fall 5-10%

- 23% felt prices would fall 10-20%

- 7% felt prices would stay the same

- 3% felt prices would increase

Long and short 90% felt that prices would fall somewhere between 5-20%. If I were on who wants to be a millionaire this would be excellent odds for phoning a friend! To take this further 97% best case scenario of flat prices to declining prices.

I also asked what the reasons behind the choices were and here are the top 5 responses

- Real estate prices are sticky downwards (up like a rocket, down like a parachute) and will not fall back to 2020 prices. They will decline modestly but plotted on a graph, it will end at 3% annual growth from 2020 to 2026, however the actual price action will look like a wave rising and falling.

- Agree prices will fall. We’ve had a prolonged period of appreciation that has outpaced increases in most people’s income.

- The chaotic manner by which the economy is being managed will eventually lead to unintended consequences and/or a policy mistake. Given the overvaluation in a residential RE market and stock markets, I believe the bubbles will deflate / burst. My portfolio is 60% cash right now patiently waiting for the eventual buying opportunity.

- Depends on general economy. As long as modest growth maintains I tend to think prices remain the same. If trump’s economic plan works, wages should increase supporting higher prices. Additionally, inflation will bump up. Since baby boomers own substantial real estate and are retiring, my sense is they will hold onto their property. Replacement cost is too high for them to move. But who knows!

- It is about affordability – affordability is function of income less out go – remaining amount is affordability. With less jobs – affordability will be down.

The survey tool also has an AI tool that summarizes all of the responses:

Based on the survey feedback collected from users regarding their opinions on real estate prices and whether they believe a reset is imminent, several trends and sentiments can be observed. A significant portion of respondents expressed agreement with the idea that real estate prices will experience a reset. Many cited economic factors, such as high-interest rates, a mismatch in supply and demand, and overall economic uncertainty as pressures leading to a downward adjustment. Notably, several respondents highlighted the impacts on affordability for first-time buyers, suggesting that current prices are unsustainable and that there is a concerning gap between housing costs and income levels. The sentiment that housing prices are less flexible downwards compared to upward movements reflects a mix of skepticism about significant declines, but many believe modest price reductions could occur. Contrarily, a minority disagreed with the idea of a price reset, arguing that the market has stabilized or that interest rates might eventually drop without causing major price declines. Some mentioned that the current economic situation and human behaviors, like the reluctance of baby boomers to sell their properties, could further stabilize home prices. Overall, while there are varied opinions, the consensus shows a leaning toward the belief that real estate prices will adjust downwards due to overarching economic factors, despite certain voices advocating for stability in the market. The recurring theme reflects a heightened sensitivity to issues of affordability and economic fluctuations affecting real estate dynamics.

Summary

Thank you everyone for your participation and insights in my first survey. The overwhelming sentiment is that there will be a price declines in the 5-10% range with also a strong probability (23%) of price declines going much deeper to 10-20%. On the flip side there is very little probability of an upside surprise in prices. These are pretty high odds and I would agree with the general sentiment of the respondents. Stay tuned for future surveys and results and please participate as your insights are critical. It will help everyone on this list make better decisions in the current chaotic environment

Additional Reading/Resources:

https://www.fairviewlending.com/will-real-estate-fall-to-2020-values/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender, residential hard money lender, commercial hard money lender, No doc real estate lender