The National Association of Business economists (NABE), the premier professional association for business economists counting Alan Greenspan as their past president, just released their business outlook predictions placing the odds of a recession in the next two years at 72%. What does this mean for the real estate market? Are we at a peak?

Details of the recent NABE survey:

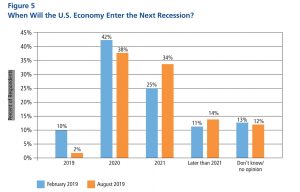

The National Association of Business Economics surveys members quarterly regarding their opinion on various economic conditions. One of the notable questions is when the next recession will occur. It is interesting to compare February with August to see the shift in perception of the economy.

In February of 2019, most economists predicted that a recession would occur sometime in 2020. By August of 2019, the probability of recession had declined in 2020 and increased in 2021.

“Survey respondents indicate that the expansion will be extended by the shift in monetary policy, and most expect the next economic recession will occur later than anticipated when the February policy survey was conducted,” said NABE President Constance Hunter, CBE, chief economist, KPMG. “Of the 98% of respondents who believe a recession will come after 2019, the panel is split regarding whether the downturn will hit in 2020 or 2021.

Why have recession odds changed?

It appears that any recession will likely occur later than originally anticipated. Economic numbers including jobs data, retail sales, etc.. have remained stronger than expected. Predicting exactly when a recession will occur is almost impossible as hundreds of variables could impact the starting of a recession from trade to various shocks to the economy. Eventually an economic cycle will happen, but exactly when is difficult to predict.

What does this mean for real estate?

Regardless of when the next recession will occur, real estate is already starting to feel the impact as consumer confidence has begun to fall and therefore real estate sales have also fallen in many markets. I don’t see consumer sentiment rebounding anytime soon as talk of recession, trade wars, etc.. continue to weigh on consumers. Real estate will continue to remain soft as the next economic cycle is now on the horizon.

Are we at a real estate peak?

I think most markets are either at their peak or already past their peak. There is no economic impetus that would drive the markets higher. With the next cycle on the horizon, there are only two options left: 1) the market flattens 2) the market declines.

Are you ready?

Regardless of when the next recession starts, the mere talk of a recession should grab your attention. Anyone invested in real estate knows from the last cycle that when the recession occurs, cash becomes tight as tenants (residential and commercial) could have issues. Now is the time to ensure you have ample liquidity.

Summary:

Although it is impossible to predict the exact timing of the next recession, several signals are pointing to a start sometime in the next 18 months. Regardless of when it starts real estate is already feeling the impacts as sales soften due to declining consumer confidence. Now is the time to make sure you are prepared for the next cycle with ample liquidity.

Additional Reading/Resources

- https://abcnews.go.com/Politics/economists-predict-us-recession-2021/story?id=65051564&cid=clicksource_77_null_bsq_hed

- https://www.nabe.com/NABE/Surveys/Business_Conditions_Survey/NABE/Surveys/Surveys.aspx

- https://www.dropbox.com/s/t3jmqd1i8ulrixp/NABE_Economic_Policy_Survey_August_2019.pdf?dl=0

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games).