Condominium owners across the country are facing a paralyzing problem: They can’t sell their properties because of a fast-growing and mostly secret mortgage blacklist. Don’t worry this is not some crazy conspiracy from the government. I’ve experienced this first hand on multiple condos in Georgia, Colorado, and Florida. What is causing the spike in “blacklisted” condos? How do properties get on the blacklist and can they get off the list? What does this mean for condo prices? What should you do?

What was in the data on blacklisted condos?

The blacklist is maintained by Fannie Mae and includes condo associations that the mortgage finance giant thinks don’t have adequate property insurance or need to make critical building repairs. Being on the list can make it harder for potential buyers to get a mortgage.

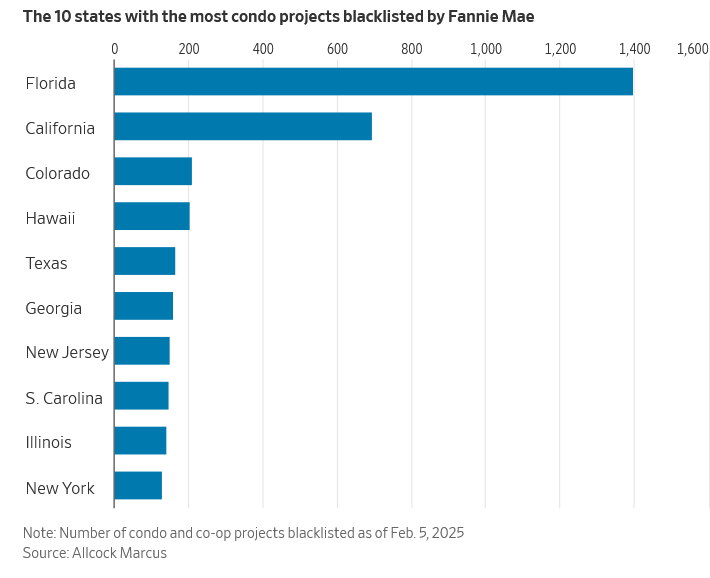

The number of properties that fail to meet Fannie Mae’s standards has risen to 5,175 this month from a few hundred before the Surfside condo collapse in Florida.

Why the huge change in number of blacklisted condos?

Fannie Mae and sister organization Freddie Mac don’t make loans, but buy roughly half of the country’s home loans from lenders and package them to sell to investors, then guarantee payments on them. Loans that meet Fannie or Freddie’s underwriting standards, known as conforming loans, can be less expensive and require lower down payments than other mortgages.

To ensure the debt can be repaid should the property be damaged or destroyed, Fannie and Freddie have long required a minimum level of insurance coverage for home loans they are willing to buy.

Last year, the firms issued clarifications of these guidelines, detailing policy no-nos that have prompted lenders to take a stricter line on insurance requirements, according to lenders, real-estate agents and insurers.

A spokeswoman for Fannie said its requirements are designed to “help protect borrowers from physically unsafe or financially unstable projects.” She disagreed with characterizing Fannie’s database of projects, which includes properties that both do and don’t meet its lending criteria, as a blacklist. She said the firm provides an online tool that allows lenders to check whether it accepts loans from a given project.

What two factors led to Condos getting on the blacklist?

There are two factors Fannie/Freddie look at to determine if a condo is suitable for financing:

- Maintenance/Reserves: After the condo collapse in FL a few years ago and new laws in many states, many complexes have found themselves severely underfunded for routine maintenance and expected expenses for roofs, foundations, elevators, hvac, etc…

- Insurance: Many condo complexes do not carry full replacement cost on insurance as required by Fannie/Freddie. One reason for the jump in insurance costs: Insurers now want to pay for the depreciated value of a damaged roof, rather than the full replacement cost, a feature Fannie and Freddie oppose. Many insurers also want to raise deductibles higher than Fannie or Freddie allow.

- A lot of associations are trying to reduce soaring insurance rates by agreeing to pared-down policies that can make their condos ineligible for mortgages backed by Fannie and Freddie. Some homeowners’ sales are falling through, and others are looking for buyers who can pay cash or get other types of loans.

- Shadow Ridge, a Los Angeles complex blacklisted in December, is in a brushfire zone but escaped this year’s infernos. Its homeowner’s association was recently quoted $2.6 million a year for a Fannie-compliant policy, 10 times the current rate, according to Jinah Kim, one of the board members.

What happens when a condo project is on the blacklist?

I’ve seen a few scenarios play out for condos that are unable to get conventional financing from Fannie/Freddie:

- Increase down payment: I’ve seen several occasions where a lender would accept the loan with a down payment of 30-35% as opposed to 20% or less depending on the lender. The issue is many of the complexes that have issues are affordable and borrowers can not afford a 35% down payment or they would be looking at a house or other property.

- Find another lender with higher rates: On a few occasions I’ve seen other lenders able to step in to finance albeit at higher rates.

- Can’t get financing: Some condos are unable to get financing at any level which leads to all cash sales

Regardless of which scenario above plays out, each one leads to much lower resale values. I’ve seen prices drop from 10% to almost 40% if it has to be an all cash purchase. If you own a condo or are looking at a condo in a blacklisted complex financing will be more difficult and or could be non existent.

Can condos get off the Fannie/Freddie blacklist?

Yes, condos can get off the blacklist, but often the costs are so high that they are not willing to pay the premium. I was looking at a condo in Colorado and the HOA dues would need to triple each month for the new insurance policy. On the flip side, in many complexes with deferred maintenance they require a special assessment that can run in the thousands or hundreds of thousands. On a recent transaction, a complex had a 50k special assessment and the unit was only worth 200k. The numbers made no sense.

Why is Colorado number three on the mortgage blacklist?

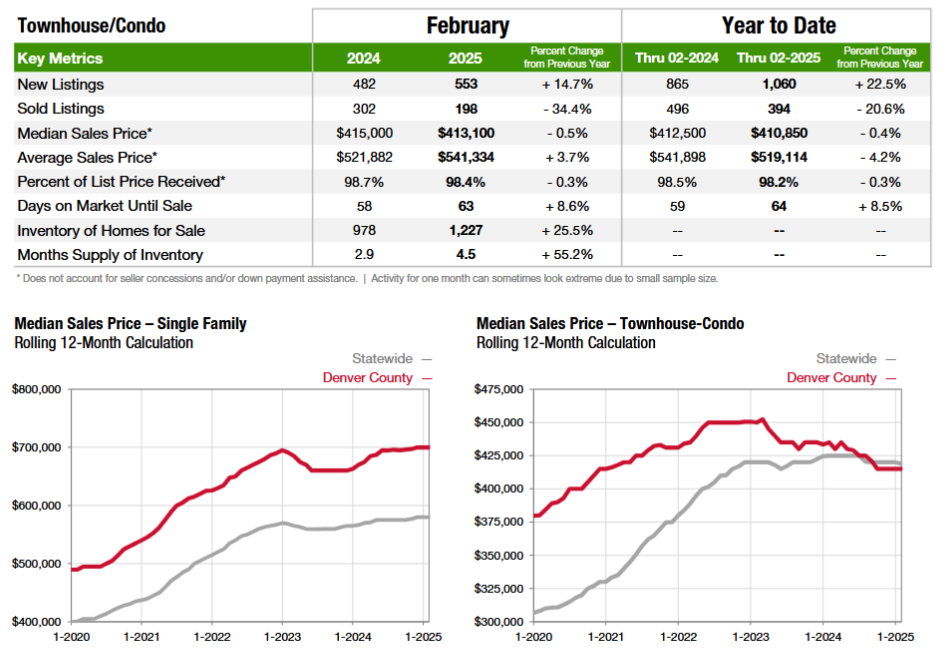

I was surprised to see Colorado on the list, but after thinking about it more, it is not really surprising. Colorado has one of the highest rates of claims for hail. As a result, insurance costs have risen exponentially in the metro area. Many complexes cannot absorb the cost of the insurance increases, and their owners are pushing for cost effective options like carrying higher deductibles or not getting full replacement costs. These choices are making many condo complexes ineligible for Fannie/Freddie loans. We can see this playing out in the data above where inventory is rising on condos in Denver and prices are falling as opposed to prices holding steady on single family homes.

How will condo prices be impacted by the mortgage blacklist?

You need to be extremely careful buying in a condo complex especially a very large multi story building that is older. Many older and larger complexes will not qualify for conventional financing due to deferred maintenance and high insurance costs which will ultimately drive prices down substantially.

Just at the beginning of the mortgage blacklist impacts

I’m actually surprised it has taken Fannie and Freddie this long to realize the problems brewing in the condo market. Over the last 20 years thousands of complexes have saved money deferring expensive maintenance and buying lower cost insurance policies, but as we can see they are now paying the price.

Although I am agreement with Fannie/Freddie on the maintenance classification of properties, the insurance issues have gotten out of control. Many lower priced properties are in a tough spot as they are unable to raise dues high enough to cover the increased costs which will ultimately lead to a huge drop in values in many older and less expensive condo units. Regardless of whether Fannie is right or wrong doesn’t really matter as at the end of the day property owners and prospective buyers are caught up in the aftermath and need to be careful.

Additional Reading/Resources:

- https://www.fairviewlending.com/property-insurance-rates-set-to-jump-by-50-why-and-who-pays/

- https://coloradohardmoney.com/condo-prices-fall-throughout-colorado/

- https://www.wsj.com/finance/regulation/condo-sales-home-insurance-crisis-a921362b?mod=mhp

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender, residential hard money lender, commercial hard money lender, No doc real estate lender