In every article I read about real estate they highlight that inventory is causing prices to fall, or high interest rates, or not enough demand. All of these items above are only symptoms. What is the real driver moving prices today? What does this mean for the remainder of the year and into next year?

Symptoms vs. actual diagnosis

When thinking about real estate, it appears real estate has caught a figurative cold meaning that the market isn’t feeling “good”. Using the cold analogy we are seeing various symptoms like rising inventory, longer time on the market, price reductions, etc… All of these items describe the effects of the cold as opposed to diagnose that you have for example a sinus infection. To truly understand the cold that real estate has, we must understand the actual root cause of the symptoms.

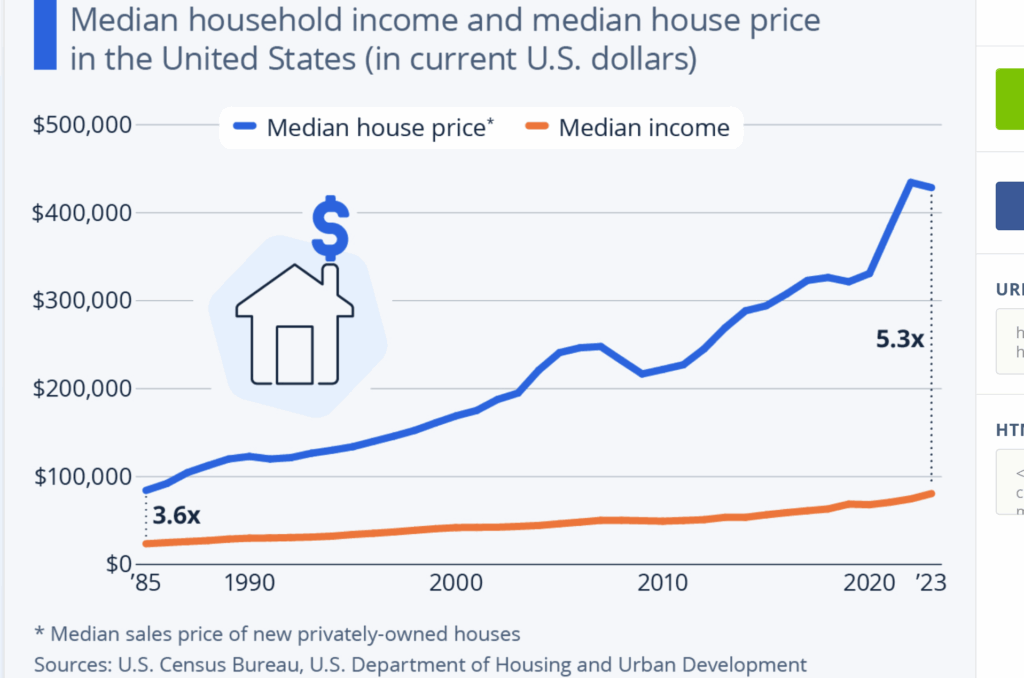

Income vs. price

Historically house prices were around 3-4% times the average income. As you can see in the chart above in 1985 the median home price was about 3.6x the median income which was considered in the healthy range. Fast forward to the present and we are approaching 5.3 times income.

To put this in perspective. Households earning $100,000 a year could afford to buy 37% of the homes listed on the market in March, according to an analysis by NAR and Realtor.com. Six years earlier, when mortgage rates and typical home prices were lower, a household earning that same amount could afford 65% of available listings. Long and short income is not coming even close to keeping up with home prices or vice versa where home prices are rising way too fast for income.

Imbalance between house prices and income didn’t matter

Over the last 15 years or so, the imbalance between house prices and income basically didn’t matter due to one factor, interest rates. For example if you could borrower at 2.75% even though you were buying a much more expensive house it wasn’t an issue as interest rates were so low and have been for so long it masked the imbalance between income and house prices.

Why did Covid supercharge prices

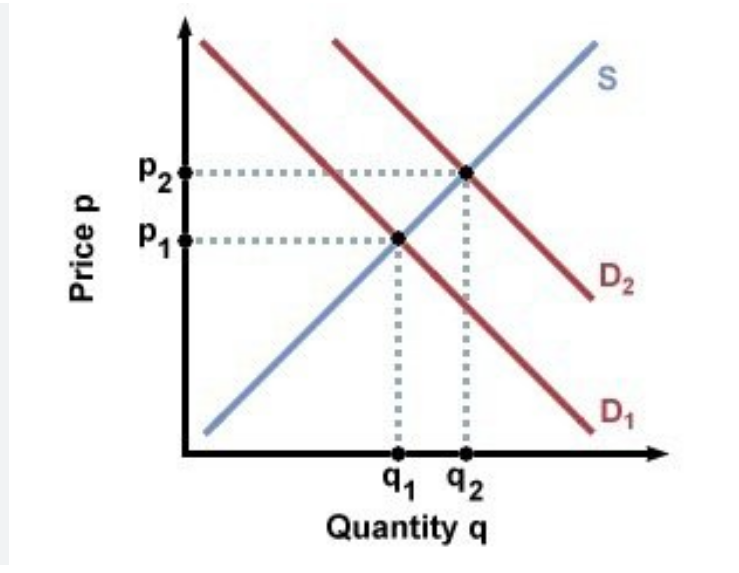

When the federal reserve and the president responded during Covid, they embarked on one of the biggest quantitative easing experiments. They pumped money into the economy via direct checks and also the federal reserve dropped interest rates to zero. On top of that the federal reserve wanted to get even more money into supply so they began buying mortgage bonds/securities to further push down mortgage rates. This lead to historically low rates. These low rates in turn spurred even more buying of real estate as buyers could afford so much at 2.75% now. What happened is basic economics illustrated by the chart below where prices increase due to a surge in demand due to ultra low rates.

Why are we just now seeing the imbalance of prices and incomes

The imbalance between prices and incomes has been there all along, we just didn’t care as interest rates covered up the divergence. Fast forward and we are in a time period of higher interest rates. Note, todays rates are about average over a 50 year or so period, they were just historically low in Covid and coming out of the 08 recession.

Unfortunately where we are today with rates is about where they will remain for the foreseeable future due to higher government deficit spending leading to higher interest rates (here is a more in depth discussion on this topic that I wrote about earlier).

Long and short the normal interest rates we are seeing now have highlighted the huge problem we have where incomes have not kept up with prices.

Can the federal reserve save the real estate market.

Many believe that the federal reserve can just swoop in and drop rates to rescue the real estate market. Unfortunately this could not be further from the truth. Remember the federal reserve only sets very short term rates (the federal funds rate) and the “market” sets mortgage rates based on the yield of the 10 year treasury. Treasury notes now are driven by huge supply from deficit spending that doesn’t seem to be getting any better anytime soon even with the new tax plan. This will lead to rates staying about where they are even if the federal reserve lowers short term rates.

What happens to real estate prices

The real estate market cannot live with prices outpacing incomes in our current interest rate environment and the fed can’t save us. Unfortunately eventually something will break which we are seeing the symptoms of today. Look at this chart for Denver Condos, clearly this market is undergoing a transition. As demand falls and inventory increases it highlights the symptoms of the huge disconnect between incomes and prices.

The only way this market shakes out is either a huge surge in income which is doubtful based on the historical increases or a large reset in prices which is more likely based on historical data. The other scenario is that prices stay about the same for the next 15 years or so for incomes to catch up to prices which I think is an even worse outcome than a reset in prices. Long and short, the masking of the disconnect between house prices and income is going to come to a head sooner rather than later.

Additional Reading/Resources

https://www.fairviewlending.com/why-are-mortgage-rates-rising-when-they-should-be-falling/

https://www.fairviewlending.com/2025-mortgage-rate-predictions/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help as my goal in writing these articles is to provide the best information/insight on Colorado Real Estate that you cannot get anywhere else! Please like and share my articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. He is the owner of Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal of this real estate blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, Hard Money Lender, Private lender, private real estate lender, residential hard money lender, commercial hard money lender, No doc real estate lender