There is definitely allot of doom and gloom heading into 23 with interest rates double their lows, inventory increasing, and prices coming off their highs. In every cycle there will be winners and losers. Where will the real estate opportunities be? Are their certain price points that will perform better/worse in 2023? What are the opportunities in 23? What markets will underperform others?

4 big changes in store for real estate in 2023:

- Lower price points will have a floor due to wall street

- 500-1.5m price range will see the pain

- Zoomtowns become doomtowns

- Exurban back to suburban or urban

Lower suburban prices points will perform better than others

There is an insatiable demand for cookie cutter type rentals backed by Wall Street. There are billions of dollars sitting on the sidelines to take advantage of the cooling prices on lower priced rentals (typically under 500k) which will put a floor under starter/lower priced homes.

At the same time, the lower price points is where the inventory shortage was most profound as it is difficult to profitability build lower priced homes in many markets. Suburban lower priced homes will be the bright spot for 2023 and an area that investors should focus on at the right price points.

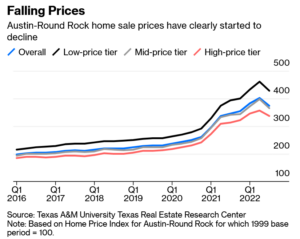

500-1.5m will see the pain

I know this is a big range (1m) but it will vary based on the market. For example in Denver the at risk properties will be 750 to 1.5m while in Atlanta it is likely closer to 500k-1m based on median prices in the respective markets.

This mid/high end price point will feel the brunt of the pain in 2023 for two reasons. First, the higher the price point, the more interest rates impact payments. Wages cannot come close to the doubling of mortgage rates which will price people out of the market. Second. The mid/high end properties are typically not the ideal rentals as the returns are lower than on lower priced properties. For example to get a 10% return on a million dollar house, the rent would need to be ~ 8400/mo. There are not many that can afford this and/or want to pay this amount in rent each month. Even with the higher rates, they could still buy if they had this cash flow.

This mid/high price point is the area to be extremely careful in as there will be a much steeper price correction.

Zoomtowns become doomtowns

Some of the hottest markets during the last three years will cool substantially. The first that comes to mind is Boise, ID but there are similar markets in every state. For example, the western slope of Colorado was a hotbed for remote workers and yet it is too far to commute into the office a few days a week. This will put substantial pressure on prices in “zoomtowns” the latter part of 2023 as the markets do not have nearly enough local employment to substantiate the price points. I would sit on the sidelines in these markets as there will be substantial downside close to 20%+.

Exurban/rural back to suburban or urban

The world is going back to many historical trends with migration back to cities/suburbs. The far out suburbs/rural locations will not be desirable as companies continue to require workers to get back into the offices at least several days a week. There will be some that want to commute 1.5 hours each way to work a few days a week, but the overwhelming majority will ultimately move closer in. Exurban/rural locations will face big price pressures in 2023 as closer in suburban locations will become increasingly desirable. There might be some buying opportunities in the right markets at a low enough price point.

Summary

Remember, in every cycle there is opportunity if you are prepared and know where to look. Fortunately this cycle is not a sky is falling type scenario like we witnessed in 08 but the market turmoil will create opportunities with lower prices at certain price points and buying opportunities.

Note that we likely will not really see the impacts of this next cycle until late 2023 so don’t think I am crazy when the market continues to hold up in the first two quarters. It will change and it could change very swiftly once the ball gets rolling. Now is the time to be careful, since 2009 anyone could make money in real estate as everything went up, now is radically different and there will be huge divergences in the upcoming market caution will be the word of the day, but opportunities should become more prevalent the later part of 2023.

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender