Fairview Commerical Lending

HARD MONEY LOANS WHEN THE BANK SAYS “NO”

Direct Private Real Estate Lender

No upfront fees

All credit OK

Loans up to 10 years

Closing in 10 days or less

Call us at 866-634-1270

Newsletter Sign Up: Join 25k+ real estate/ finance pros weekly to learn expert tips/trends

Fairview Commercial Lending is a privately funded direct hard money lender

Hard Money Blog:

Recent Posts

Canada eliminates private property impacts US

Who would every imagine that British Columbia, Canada would eliminate private property rights costing property owners billions of dollars. What was the bombshell ruling? Why is it almost impossible...

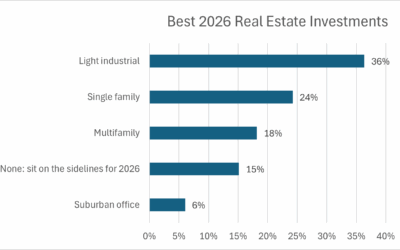

Best 2026 real estate investments

Last week I asked all of you what was the top property type to invest in 2026? The real estate pros have spoken and as you can see from the chart above, the majority (36%) are going...

Where should you invest in real estate in 2026?

The pandemic turned the real estate market upside down with real estate values surging throughout the country. With values rising everywhere, everyone seemed like a winner. Unfortunately, the boom...

Hard Money / Private Money Loan Programs

Residential Hard Money Loans

Commercial Hard Money Loans

We focus on bridge loan/private loans/ asset based lending on general purpose commercial properties: Office, retail, light industrial, mixed use, multifamily, and Marijuana properties (Colorado only). No appraisals or upfront fees required saving the borrowers thousands. See why Fairview is the leader in Commercial hard money loans. Closings typically in 5-10 days.

Recently Closed Loans

See What Our Clients Are Saying About Us

If you're looking for an *amazing* real estate blog, written by a real person who KNOWS what he's talking about, subscribe on Fairview's site. Can't recommend it enough. Thank you Glen..

In short, if you need a loan, you can't go wrong with Glen & Fairview Lending.

Fairview Lending is able to lend on THEIR value of your real estate without a credit report or a professional appraisal. Tired of the typical lender delays and required never-ending "guideline

requirements" ? Get in touch with

Glen of Fairview Lending he will get you where you want to be within a matter of just clearing title and setting a closing date, you WILL NOT be disappointed.

Michael Little, Colorado Employing

Real Estate Broker since 1982.

!! They had my loan funded in less than 8 business days from the initial phone call. I live in Florida and everything was done in what I can only say was the shortest amount of time possible that I have ever experienced. They were on point, punctual, and professional. I would highly recommend them to anyone that is looking for financing. Thank you Fairview!

Robert West

DBW Management LLC

Daniel Peterson

Over 40 years Of Expertise

- Loans on Residential Investment, Commercial, Agricultural, and Marijuana properties

- Closing and funding in 5-10 days

Newsletter Sign Up: Join 25k+ real estate/ finance pros weekly to learn expert tips/trends

Hard Money / Private Money : Where we lend

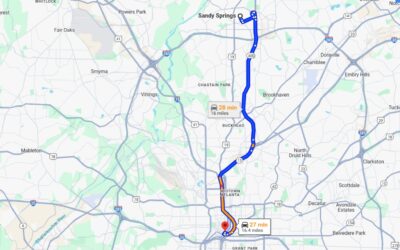

Georgia Hard Money Loans

We are headquartered in Atlanta (Sandy Springs). We are experts in Atlanta Georgia real estate as we are 5th generation natives of Georgia and have over 100 years of Georgia commercial and residential real-estate lending experience. We can assist on your private lending needs throughout GA.