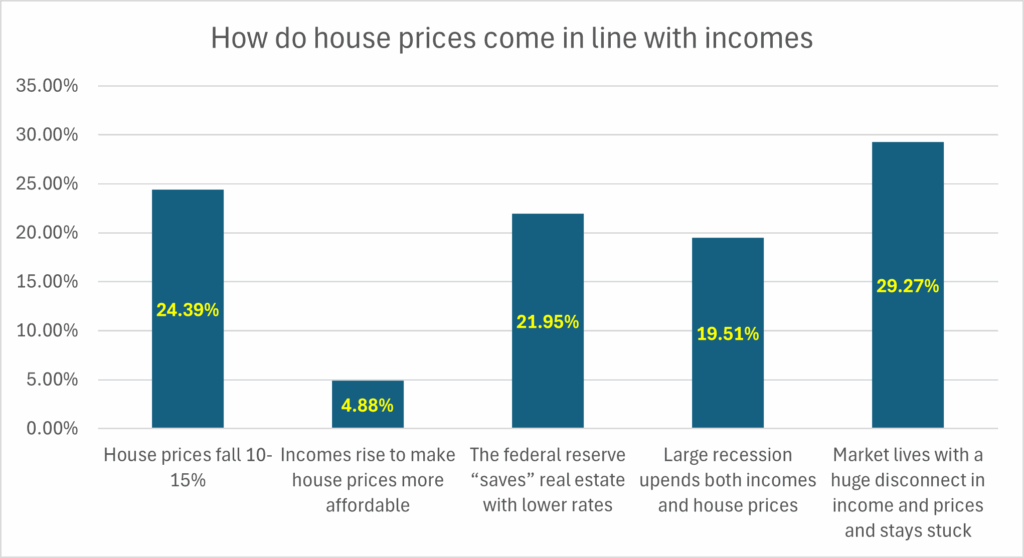

Last week I asked all of you how do house prices and incomes come back into historical alignment? As you can see from the chart above, the responses were not very clear cut but the consensus is that real estate is likely “stuck” for some time.

How do house prices come back into historical alignment with incomes?

If we look historically there is a ratio of house prices to income that has gotten way out of wack recently for various reasons including ultra low rates. This disconnect cannot happen forever and something has to give either incomes slowly rise or prices fall or some combination.

The most selected answer was that real estate basically stays stuck for a while. This is basically the situation we are in today where sellers and buyers are at an impasse with no clear movement one way or the other. Sellers are refusing to lower prices while at the same time buyers are just waiting for rates to miraculously drop to Covid levels that will likely never happen.

The second highest picked answer is that real estate prices fall in the 10-15% range helping prices come into better alignment with incomes. This is also a very probable outcome based on rising inventories.

The third highest picked answer is that the fed saves the day with lower rates. Unfortunately I think this is very unlikely as the only way the fed will cut substantially is if shit hits the fan and sees a recession on the horizon which would ultimately lead to lower prices.

Summary

Thank you everyone for your participation and insights in my survey. The insight in the comments from readers was amazing and I hope everyone gained a good perspective from your fellow readers. My key takeaway from this survey is that the most likely scenario is a situation where real estate stays stuck which is the best case and there is also a likely case that real estate falls 10-15% to better align prices with income. Thanks again and stay tuned for upcoming surveys

Additional Reading/Resources:

https://www.fairviewlending.com/the-war-on-landlords/

https://www.fairviewlending.com/house-prices-hit-another-record-should-you-even-care/

https://www.fairviewlending.com/root-cause-of-real-estate-price-declines/

https://www.fairviewlending.com/will-real-estate-fall-to-2020-values/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender, residential hard money lender, commercial hard money lender, No doc real estate lender