Will the housing crisis happen again? Are you ready to bail out the mortgage industry to the tune of $100 billion? What can you do to protect yourself from the next downturn? Can you identify the areas that are most likely to turn in the next crisis? There is one free metric that can predict the risk of a particular neighborhood.

A recent report shows that Fannie/Freddie would need 100 billion in a new crisis according to stress test results released Monday by their regulator. Fannie/Freddie are the largest buyers of US mortgages and after the last crisis are basically under the control of the treasury department which puts you and I, the taxpayers, on the hook for any losses/bailouts. Why is this scenario likely to come to fruition?

40% of all purchases over the last 12 months were low down payment loans, this encompasses over 1.5 million borrowers. Borrowers putting between 5 to 9 percent down grew at double the market average (source: Black Knight Analytics). Furthermore, over 25% of all lending by the government sponsored entities (Fannie/Freddie) was subprime (less than 10% down).

What is subprime? Subprime lending (or non-prime) is basically any loan where the borrower puts less than 20% down. Why is 20% the magic number? Let’s look at what happened during the last recession. Remember prices can go down, and go down substantially. The last recession showed that borrowers with less than 20% down were substantially more likely to default on their loans. Why? In a recession with values dropping if you put only 5% down, the borrower is underwater almost immediately. In other words, the house is worth less that is owed. It doesn’t take a deep recession to see a 5-10% drop in values. A little hiccup in the economy could knock prices down 5-10% especially in higher cost areas like the Colorado front range where borrowers are spending larger portions of their income on housing.

Wait, everything is different now in the mortgage market! We cannot have the same issues again with Dodd Frank, etc…! I hear the arguments now, default rates are at the lowest since the recession, underwriting is tougher, credit scores are higher and the list goes on.

What has changed since the last crisis?

- Credit: There are typically higher credit requirements today. The difference is that the credit score naturally is higher during better economic times. Furthermore, credit scores have trended up as the scoring methodology has changed to eliminate many negative items on a credit report (See: Ready for a summer boost to your credit score).

- Income: Gone are the days of the “liar loans” as they were called. Income is verified more thoroughly.

- Appraisals: In the past there was collusion amongst appraisers, realtors, lenders, etc… to solve this problem a new appraisal system was put in place where appraisals were ordered through a central company so that there could not be influence by the realtors/lenders. The appraiser on a residential house is basically “assigned” by the third-party company. This sounds great in theory; the problem is you might not have an appraiser that specializes in the area. For example, I did a refinance on my house with a major bank, they sent an appraiser from Longmont, who had no clue about the intricacies of the Evergreen market. His value was off by about 40% since he had no expertise in the unique factors that impact mountain real estate.

- Loan to Value: During the beginning of the recovery lenders made little if any non-conventional loans. As the recovery has progressed, we are back to the same party. As prices have risen, borrowers are unable to put down the full 20% so programs have been adjusted to enable lower down payment options. This allows lenders to continue lending and keep their revenues flowing.

Of the four factors above, one factor is exponentially more important than the others. Being a hard money lender and riding through the last mortgage crisis with no bailout from the government, we learned real quick what happens in a market downturn. The number one factor on whether a lender will take a loss is Loan to Value. As a private lender in the last crisis we had a unique perspective to see how our lending practices performed under stress. We lend our own funds, look at every property, and service our loans. We get to see the whole loan cycle (as opposed to many banks that pool their loans and securitize them). As the crisis unfolded we spread out the portfolio based on credit, income, loan to value, etc… the primary indicator of whether we would take a loss or not was the leverage the borrower utilized. For example, in Colorado in the last crisis subprime loans were less than 40% of all loans, but accounted for 77% of all the foreclosures. Why?

In a downturn, markets fall! A cascading effect occurs; the market falls, dampens consumer confidence, decreases consumer spending and businesses in turn cut back to accommodate the lower spending level (layoffs, fewer purchases, etc…). Borrowers that have equity in their commercial or residential property are considerably more likely to make a payment. In the last crisis, there were a considerable number of “strategic defaults” where the borrower could make a payment but chose not to since the house was underwater. The theory goes “why throw good money away when I can go rent or buy another house for less than what I currently owe?”. This is a simplistic explanation of what happened in the last crisis and what will happen again. The depth of how this plays out in the next crisis is the question.

What does this have to do with Fannie/Freddie the largest purchasers of residential mortgages? With 25% of mortgages originated having less than 10% down, the probability of major defaults has been amplified. It is highly likely that there will need to be a huge bailout by U.S. taxpayers to the tune of 100 billion dollars or more (this doesn’t include bailouts of FHA or VA which also makes subprime loans with down payments less than 5%!). With all this talk of subprime defaults, how does this impact you? Are there steps you can take to identify if your neighborhood is at risk. Fortunately, the answer is yes!

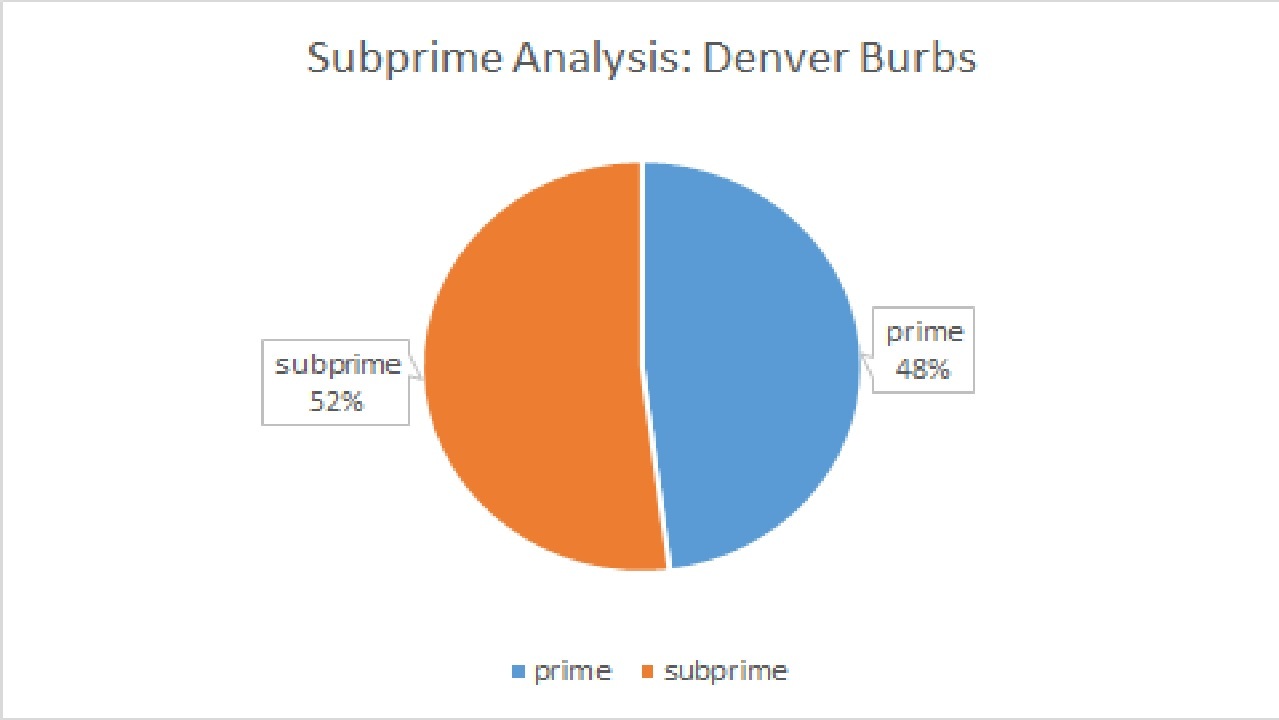

What should you do? As mentioned above, areas with higher portions of subprime loans are at much great risk of default. This trend is neighborhood specific. How can you identify the risk to your neighborhood? I did an analysis of a few suburbs in Denver about a year ago and found my neighborhood had almost 52% of recent sales comprised of subprime loans (I used lender tools to see the sale price and down payment on the recent sales). This was considerably higher than other areas not far from my neighborhood. I was floored at the number of subprime loans around my house. What did I do? I sold and moved to an area that was not nearly as dependent on subprime loans to protect myself in a downturn.

Is the above chart indicative of your neighborhood? Everyone should take the time to look around your neighborhood at the recent sales and see what percentage people are putting down (you can also get this information from your local assessor’s office). The lower the down payment the higher the risk your neighborhood will fall in the next downturn. You will likely be surprised at the “price riskiness” of your neighborhood. With values still moving higher, now is the time to identify if your property is at risk and take action to position yourself for the next cycle

Resources:

- http://www.bkfs.com/CorporateInformation/NewsRoom/Pages/20170807.aspx

- http://www.corelogic.com/about-us/news/corelogic-reports-may-2017-delinquency-rate-lowest-in-nearly-a-decade.aspx

- http://www.valueinsured.com/trendsource/2017/8/9/americans-concerned-that-hot-housing-market-could-be-heading-for-a-correction

- http://c.ymcdn.com/sites/www.coloradobankers.org/resource/resmgr/imported/Fact%20Sheet.pdf

- http://www.cobizmag.com/Trends/Think-were-out-of-the-mortgage-mess/

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games)