Job’s report tanks, one step to take now to save money

With the jobs report last week what is one step everyone should take now.

With all the hype that the economy continues to improve (thank the politicians), there are still strong undercurrents. Last week’s jobs report threw water on the theory that the economy is “rosy”. But, there is a silver lining in the recent data that could save you thousands.

What is one simple financial step you should consider taking after the jobs report to save money. This step is totally counter intuitive!

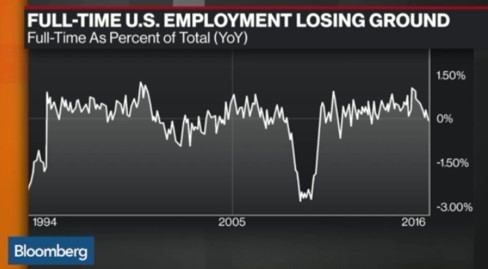

The jobs report definitely surprised everyone including the fed as expectations were high that the economy was continuing to gain traction. If you missed it, take a look at this report Bloomberg did; look at the last chart, it doesn’t give the warm and fuzzy feeling that the politicians want us to believe.

Ironically, I personally wasn’t overly surprised. I saw a study a few months back that showed rail volume (excluding oil/gas shipments) had declined. This is usually an indicator of trouble to come. Also Well’s Fargo did an interesting report a few months ago stating the risk of a correction was 26%. Here is a full report with their commentary that is a must read.

So what should you do as a result? I personally took one step that is saving me a ton of money. I refinanced. Although not earth shattering rates are at historic lows so now is a great time to get into a lower rate…. But there is more! I didn’t just do a plain vanilla refinance, I went into an adjustable rate mortgage and just locked in under 3% for 10 years.

That is silly (or just plain dumb!), why would you go with an ARM with rates at historic lows. Well, from the jobs report, inflation is going to be held in check and therefore rates will rise nominally at best. So instead of paying a 1%+ premium to lock in a rate for 30, locking in for 10 is a smart move. Let’s do a quick analysis. Say you borrowed 1m dollars. On an ARM jumbo you can lock in around 2.875%, a 30 year fixed jumbo is around 4%, the savings is 11, 250 dollars/year. The average person stays in their home around 10 years or less so the savings over this period would be $112,500.

So what if rates rise? Rates could rise in the short term, but I strongly believe (and most economists also believe) that we are somewhere near the top or the tail end of a cycle. So somewhere in the next 5 years there will be some sort of correction or distress in the market. If you feel at that point you are going to stay in the house for longer than the 10 years, then refinance into another ARM (even after five years you still would have saved almost 60k.

Long and short, in every cycle there is opportunity. Use the recent dismal jobs data to save yourself substantial money by going against the tide.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.